segunda-feira, dezembro 05, 2005

sexta-feira, outubro 14, 2005

Análise Lexmark

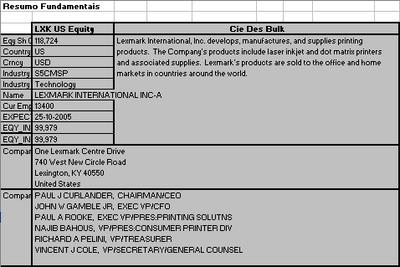

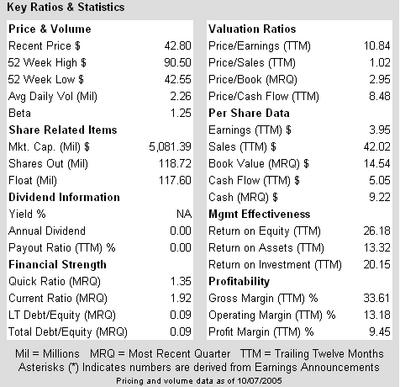

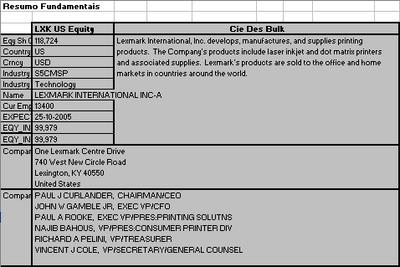

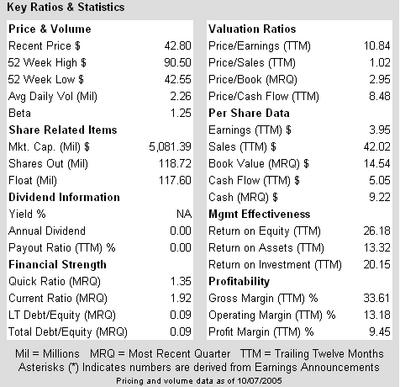

A segunda marca mundial de impressoras vem comunicando reduções sucessivas nas vendas e correspondentes lucros. A grande rival, a HP, tem vindo a pressionar bastante os preços numa estratégia de reestruturação que envolve despedimentos de pessoal, fecho de departamentos e reduções de preços e margens. No entanto, estas reduções não são sustentáveis e a estabilidade há-de regressar ao sector.

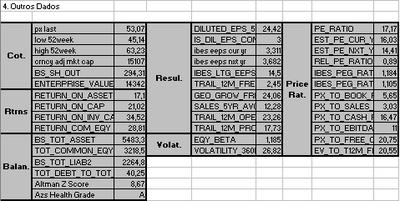

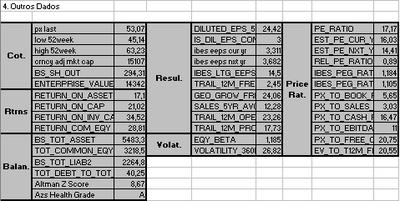

A Lexmark possui um historial de resultados muito bom como podem comprovar os dados fundamentais abaixo. Por outro lado, só este ano já caiu quase 50%! Os múltiplos encontram-se em níveis historicamente baixos.

Neste momento tenho uma posição de $3000 mas vou reforçar.

Ficam os dados fundamentais, os gráficos, uma avalição do seu valor intrínseco recorrendo ao modelo dos free cash flows descontados e os movimento efectuados até hoje.

Avaliação do Valor Íntrinseco da Lexmark assumindo um custo do capital de 9.93% e uma LT Growth Rate de 10.5% durante 10 anos.

Através deste método podemos concluir que cada acção da Lexmark vale $99.57, ou seja, 133.95% acima do preço actual!

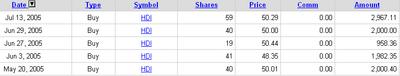

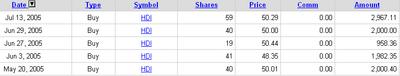

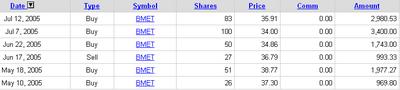

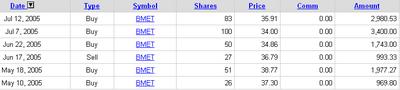

Ficam os movimentos no título:

A Lexmark possui um historial de resultados muito bom como podem comprovar os dados fundamentais abaixo. Por outro lado, só este ano já caiu quase 50%! Os múltiplos encontram-se em níveis historicamente baixos.

Neste momento tenho uma posição de $3000 mas vou reforçar.

Ficam os dados fundamentais, os gráficos, uma avalição do seu valor intrínseco recorrendo ao modelo dos free cash flows descontados e os movimento efectuados até hoje.

Avaliação do Valor Íntrinseco da Lexmark assumindo um custo do capital de 9.93% e uma LT Growth Rate de 10.5% durante 10 anos.

Através deste método podemos concluir que cada acção da Lexmark vale $99.57, ou seja, 133.95% acima do preço actual!

Ficam os movimentos no título:

quinta-feira, setembro 15, 2005

Análise Capital One Financial

Dando continuação à análise da semana passada, hoje vou apresentar alguns dados de outra empresa de cartões de crédito na qual entrei depois do negócio da MBNA. O sector encontra-se em concentração e esta é uma empresa apetecível de rentabilidades impressionantes. A Capital One vai comprar um banco (Hibernia) sendo este mais um movimento estratégico para potenciar o escoar dos seus cartões de crédito.

Entrei a 80.30 e só reforço no suporte dos 75. Isto porque caso recue tem um gap grande que só pára nesses valores.

Ficam os dados fundamentais e os gráficos. Deixo, também, um modelo de avaliação extremamente simples e bastante conservador que assume crescimento perpétuo estável.

O seguinte modelo de avaliação pressupõe crescimento estável no longo prazo. São utilizadas três medidas de avaliação: Os Earnings per Share, os Earnings per Share from Continuous Operations (excluindo resultados extraordinánios) e o Free Cash Flow. Por outro lado, também são definidas três taxas de desconto dos resultados no longo prazo: Taxa Juro sem Risco (com crescimento lucros nulo), WACC - Weight Average Cost Capital (com crescimento lucros nulo) e WACC menos taxa de crescimento de longo prazo constante. Deste modo, são calculadas 9 medidas de avaliação (umas mais conservadoras que outras) fazendo simplemente a medida dos resultados a dividir pela taxa de desconto dos mesmos.

Pode-se ver que em todas as medidas de avaliação (mesmo nas mais conservadoras) a acção encontra-se a desconto. Por exempo, se tivermos em conta o EPS/WACC que pressupõe o mesmo resultado do último ano para sempre actualizados para a data de hoje à taxa WACC, aponta para um valor intrínseco de 95.80, ou seja, 19.26% acima da cotação actual.

Entrei a 80.30 e só reforço no suporte dos 75. Isto porque caso recue tem um gap grande que só pára nesses valores.

Ficam os dados fundamentais e os gráficos. Deixo, também, um modelo de avaliação extremamente simples e bastante conservador que assume crescimento perpétuo estável.

O seguinte modelo de avaliação pressupõe crescimento estável no longo prazo. São utilizadas três medidas de avaliação: Os Earnings per Share, os Earnings per Share from Continuous Operations (excluindo resultados extraordinánios) e o Free Cash Flow. Por outro lado, também são definidas três taxas de desconto dos resultados no longo prazo: Taxa Juro sem Risco (com crescimento lucros nulo), WACC - Weight Average Cost Capital (com crescimento lucros nulo) e WACC menos taxa de crescimento de longo prazo constante. Deste modo, são calculadas 9 medidas de avaliação (umas mais conservadoras que outras) fazendo simplemente a medida dos resultados a dividir pela taxa de desconto dos mesmos.

Pode-se ver que em todas as medidas de avaliação (mesmo nas mais conservadoras) a acção encontra-se a desconto. Por exempo, se tivermos em conta o EPS/WACC que pressupõe o mesmo resultado do último ano para sempre actualizados para a data de hoje à taxa WACC, aponta para um valor intrínseco de 95.80, ou seja, 19.26% acima da cotação actual.

terça-feira, setembro 13, 2005

Value Isn't Just a Number

By Stephen D. Simpson, CFA September 12, 2005

It's all too appealing to try to reduce investing to simple numbers. An undervalued ratio here, an above-average metric there, and you're good to go, right? Well, maybe not. Although numbers have their place, they must be kept in their place -- that is, as an aid to analysis and decision making, but not a driving factor. I believe that when investors look back on the history of successful companies and winning stock picks, they will see that true value is not just a sequence of numbers.

Numbers don't tell the whole truthMany different dead people are reported to have originally uttered the line "lies, damn lies, and statistics." Whoever actually said it was on to something. Numbers may be a convenient measurement tool, but what happens when management decides to tinker a bit with them? How many people bought into the Enron or WorldCom stories because they were seduced by the numbers?

Apart from these two examples of outright fraud, there are numerous companies that actively attempt to manage their earnings. A change in inventory valuation here or a readjustment of depreciation schedules there and you can smooth over quarter-by-quarter or year-by-year comparisons. Maybe this isn't a blatantly "bad" thing -- after all, investors seem to like steady growth in earnings and stock prices -- but it does point to a reason as to why you might not want to place undue reliance on the numbers.

Let's also not forget that accounting isn't necessarily meant to be used in the way that many investors try to use it. Modern accounting principles are mostly built for the purpose of tracking the movement of cash into, around, and out of a business entity. As such, it has certain limitations.

For instance, accounting treats most research and development as an expense, yet clearly companies view R&D as at least partially an investment in future products and competitiveness. If R&D is simply an expense and not a cumulative asset, why then are biotech, med-tech, and some technology companies acquired when they have no earnings and no products yet on the market?

Likewise, why aren't capital expenditures treated as an expense? Sure, you can argue that depreciation is a proxy for the need to replenish the company's capital base, but there is no requirement for a company to distinguish between "maintenance" capital expenditures and growth capital expenditures. Likewise, assets are frequently depreciated irrespective of their actual current values -- meaning that some companies may hold property that is worth little on the balance sheet (because it has been depreciated), but worth quite a bit in real life.

Simply put, modern accounting is not concerned with what really matters in evaluating a successful business -- producing an economic return on capital that is in excess of the cost of that capital. Sure, you can (and have to) use accounting inputs like pre-tax profit in your calculations, but ultimately you need to leave accounting behind to establish reasonable estimates of discounted cash flow, economic value added, or many other methods of company valuation.

Management trumps numbersIt seems as though some people forget that numbers don't run businesses -- people do. And above-average people have proved time and time again that they are capable of doing far more than what mere numbers would suggest. In other words, good management trumps numbers.

Airlines are a lousy business -- but Herb Kelleher created a winner with Southwest Airlines (NYSE: LUV). Biotechnology is the graveyard of investor dreams, but George Rathman has founded two winners -- the incredible Amgen (Nasdaq: AMGN), as well as ICOS (Nasdaq: ICOS). I couldn't count the number of failed e-businesses, but Jeff Bezos' Amazon.com (Nasdaq: AMZN) is still thriving. Could you have identified all (or any) of these winners based on solid numbers alone? I'd argue "no."

Simply put, you can't quantify the above-average opportunities that are created by talented and visionary managers. Unfortunately there is no price-to-creativity ratio, nor a way to measure return on management vision. Sustainable competitive advantages and economic moats are hard to quantify much beyond "I know 'em when I see 'em," and yet they are critical components to long-term stock market success.

In the absence of a Michael Dell ratio, remember that numbers are either reflective (looking back on reported results) or prospective (projecting future results), but they themselves don't produce anything. One person may build a model showing Overstock.com (Nasdaq: OSTK) to be overvalued by 50%, another person can produce a model showing the stock to be undervalued by 50%. In either case, the numbers themselves don't make it so; management and competition ultimately write the story.

Cheap can be cheap for a reasonPerhaps it's because I identify myself with the value crowd, but I happen to think that value investing is the most misunderstood investment philosophy. Look at a lot of popular investment books and you get the sense that value investing is all about numbers -- P/Es, price-to-book ratios, and so on. This not only gives short shrift to what real value investing is all about, but it can be dangerous for the novice or lazy investor.

Too often investors look only at a P/E ratio or maybe an enterprise value-to-free cash flow (EV/FCF) ratio and declare a company "cheap" or a "value stock." Unfortunately, these cheap numbers are easily misunderstood. Cheap is not cheap if the company is at a cyclical peak and earnings are about to go into decline. Cheap is not cheap if the company or industry are no longer competitive and are instead doomed to eventual decline (consider Berkshire Hathaway's namesake investment in the textile industry).

Likewise, a company about to begin a cyclical upswing will not look cheap. A company that has staunched the bleeding and begun a turnaround will not look cheap. A company with a proven competitive advantage and a solid growth outlook will not look cheap. And yet, all three of these archtypes can certainly be core value investment ideas.

What "real value" isSo if value isn't to be found hidden in a ratio or buried in a formula, where do you find it? Ideally, real value is a long-term competitive advantage purchased at a good price that includes a margin of error. I say "ideally" because cyclical companies and turnaround candidates can also be true value stocks if purchased correctly -- the long-term sustainable competitive advantage may be lacking, but a large enough discount to intrinsic value can make up the difference.

Identifying quality turnaround and cyclical opportunities is a subject for another day, so I'll instead focus on some thoughts about core value companies. These are companies with strong economic moats -- sustainable competitive advantages that help to insulate the company from competitors and allow for above-average earnings growth. These are also companies that produce real economic value -- meaning that they can take a pool of capital and reliably achieve financial returns well in excess of the cost of that capital. That might seem simple and obvious, but not many companies manage to do it for the long term.

Last, but not least, real value is a company that has a great management team with access to reasonably priced capital and free economic opportunities to expand. Don't overlook this latter point, as few companies can match Motley Fool Inside Value pick Coca-Cola (NYSE: KO) and do basically the same thing for decades on end. Microsoft (Nasdaq: MSFT) has expanded far beyond computer operating systems, IBM has long since grown beyond adding machines, and AIG is not "just" an insurance company.

We look for real valueDon't worry -- you're not out on your own looking for true value opportunities. We have an entire team at The Motley Fool that does little else but look for high-quality companies trading at very attractive prices. This Inside Value team has already done quite well for its subscribers, and I believe that any investors who want to appreciate true value investing should at least take a 30-day trial subscription to the newsletter service.

Bottom lineRemember, value isn't a number. There is no ratio or combination of formulas that can reliably guide you to true value opportunities. Successful investing is not mechanical -- it's subjective and qualitative. Numbers are a crucial part of the process and can reveal important information, but they must be kept in context. Like light reflecting off a mirror, investors should remember that numbers can reflect the state of a company -- but they aren't themselves the company. By looking beyond the numbers and appreciating them in context, investors can unearth the true values in the stock market and beat the conventional averages.

in MotleyFool.com

It's all too appealing to try to reduce investing to simple numbers. An undervalued ratio here, an above-average metric there, and you're good to go, right? Well, maybe not. Although numbers have their place, they must be kept in their place -- that is, as an aid to analysis and decision making, but not a driving factor. I believe that when investors look back on the history of successful companies and winning stock picks, they will see that true value is not just a sequence of numbers.

Numbers don't tell the whole truthMany different dead people are reported to have originally uttered the line "lies, damn lies, and statistics." Whoever actually said it was on to something. Numbers may be a convenient measurement tool, but what happens when management decides to tinker a bit with them? How many people bought into the Enron or WorldCom stories because they were seduced by the numbers?

Apart from these two examples of outright fraud, there are numerous companies that actively attempt to manage their earnings. A change in inventory valuation here or a readjustment of depreciation schedules there and you can smooth over quarter-by-quarter or year-by-year comparisons. Maybe this isn't a blatantly "bad" thing -- after all, investors seem to like steady growth in earnings and stock prices -- but it does point to a reason as to why you might not want to place undue reliance on the numbers.

Let's also not forget that accounting isn't necessarily meant to be used in the way that many investors try to use it. Modern accounting principles are mostly built for the purpose of tracking the movement of cash into, around, and out of a business entity. As such, it has certain limitations.

For instance, accounting treats most research and development as an expense, yet clearly companies view R&D as at least partially an investment in future products and competitiveness. If R&D is simply an expense and not a cumulative asset, why then are biotech, med-tech, and some technology companies acquired when they have no earnings and no products yet on the market?

Likewise, why aren't capital expenditures treated as an expense? Sure, you can argue that depreciation is a proxy for the need to replenish the company's capital base, but there is no requirement for a company to distinguish between "maintenance" capital expenditures and growth capital expenditures. Likewise, assets are frequently depreciated irrespective of their actual current values -- meaning that some companies may hold property that is worth little on the balance sheet (because it has been depreciated), but worth quite a bit in real life.

Simply put, modern accounting is not concerned with what really matters in evaluating a successful business -- producing an economic return on capital that is in excess of the cost of that capital. Sure, you can (and have to) use accounting inputs like pre-tax profit in your calculations, but ultimately you need to leave accounting behind to establish reasonable estimates of discounted cash flow, economic value added, or many other methods of company valuation.

Management trumps numbersIt seems as though some people forget that numbers don't run businesses -- people do. And above-average people have proved time and time again that they are capable of doing far more than what mere numbers would suggest. In other words, good management trumps numbers.

Airlines are a lousy business -- but Herb Kelleher created a winner with Southwest Airlines (NYSE: LUV). Biotechnology is the graveyard of investor dreams, but George Rathman has founded two winners -- the incredible Amgen (Nasdaq: AMGN), as well as ICOS (Nasdaq: ICOS). I couldn't count the number of failed e-businesses, but Jeff Bezos' Amazon.com (Nasdaq: AMZN) is still thriving. Could you have identified all (or any) of these winners based on solid numbers alone? I'd argue "no."

Simply put, you can't quantify the above-average opportunities that are created by talented and visionary managers. Unfortunately there is no price-to-creativity ratio, nor a way to measure return on management vision. Sustainable competitive advantages and economic moats are hard to quantify much beyond "I know 'em when I see 'em," and yet they are critical components to long-term stock market success.

In the absence of a Michael Dell ratio, remember that numbers are either reflective (looking back on reported results) or prospective (projecting future results), but they themselves don't produce anything. One person may build a model showing Overstock.com (Nasdaq: OSTK) to be overvalued by 50%, another person can produce a model showing the stock to be undervalued by 50%. In either case, the numbers themselves don't make it so; management and competition ultimately write the story.

Cheap can be cheap for a reasonPerhaps it's because I identify myself with the value crowd, but I happen to think that value investing is the most misunderstood investment philosophy. Look at a lot of popular investment books and you get the sense that value investing is all about numbers -- P/Es, price-to-book ratios, and so on. This not only gives short shrift to what real value investing is all about, but it can be dangerous for the novice or lazy investor.

Too often investors look only at a P/E ratio or maybe an enterprise value-to-free cash flow (EV/FCF) ratio and declare a company "cheap" or a "value stock." Unfortunately, these cheap numbers are easily misunderstood. Cheap is not cheap if the company is at a cyclical peak and earnings are about to go into decline. Cheap is not cheap if the company or industry are no longer competitive and are instead doomed to eventual decline (consider Berkshire Hathaway's namesake investment in the textile industry).

Likewise, a company about to begin a cyclical upswing will not look cheap. A company that has staunched the bleeding and begun a turnaround will not look cheap. A company with a proven competitive advantage and a solid growth outlook will not look cheap. And yet, all three of these archtypes can certainly be core value investment ideas.

What "real value" isSo if value isn't to be found hidden in a ratio or buried in a formula, where do you find it? Ideally, real value is a long-term competitive advantage purchased at a good price that includes a margin of error. I say "ideally" because cyclical companies and turnaround candidates can also be true value stocks if purchased correctly -- the long-term sustainable competitive advantage may be lacking, but a large enough discount to intrinsic value can make up the difference.

Identifying quality turnaround and cyclical opportunities is a subject for another day, so I'll instead focus on some thoughts about core value companies. These are companies with strong economic moats -- sustainable competitive advantages that help to insulate the company from competitors and allow for above-average earnings growth. These are also companies that produce real economic value -- meaning that they can take a pool of capital and reliably achieve financial returns well in excess of the cost of that capital. That might seem simple and obvious, but not many companies manage to do it for the long term.

Last, but not least, real value is a company that has a great management team with access to reasonably priced capital and free economic opportunities to expand. Don't overlook this latter point, as few companies can match Motley Fool Inside Value pick Coca-Cola (NYSE: KO) and do basically the same thing for decades on end. Microsoft (Nasdaq: MSFT) has expanded far beyond computer operating systems, IBM has long since grown beyond adding machines, and AIG is not "just" an insurance company.

We look for real valueDon't worry -- you're not out on your own looking for true value opportunities. We have an entire team at The Motley Fool that does little else but look for high-quality companies trading at very attractive prices. This Inside Value team has already done quite well for its subscribers, and I believe that any investors who want to appreciate true value investing should at least take a 30-day trial subscription to the newsletter service.

Bottom lineRemember, value isn't a number. There is no ratio or combination of formulas that can reliably guide you to true value opportunities. Successful investing is not mechanical -- it's subjective and qualitative. Numbers are a crucial part of the process and can reveal important information, but they must be kept in context. Like light reflecting off a mirror, investors should remember that numbers can reflect the state of a company -- but they aren't themselves the company. By looking beyond the numbers and appreciating them in context, investors can unearth the true values in the stock market and beat the conventional averages.

in MotleyFool.com

quinta-feira, setembro 08, 2005

Análise MBNA

Hoje vou apresentar a análise a uma empresa que já fez parte da carteira mas cuja posição fechei entretanto: a MBNA (Ticker: KRB). Trata-se de uma empresa de cartões de crédito com rentabilidades impressionantes e crescimento de resultados incrivelmente consistentes.

Este caso é, ao mesmo tempo, um excelente exemplo do que procuro demonstar com este método de investimento mas, também, uma situação que pode iludir os investidores mais ansiosos.

O gráfico da cotação vinha variando entre 23.5 e os 29 e face ao PER que estava na altura (cerca de 11) esperei que viesse retestar o suporte para entrar. Assim aconteceu, quando entrei no dia 18/04, precisamente nos 23.5 com $5000. Exactamente passados 3 dias, na divulgação de resultados da empresa, ela anuncia que as perspectivas de crescimento de resultados para os próximos trimestres serão abaixo do previsto, uma vez que muito do crédito concedido estava a ser, extraordinariamente, liquidado. As acções caíram mais de 18%.

Nesta altura com uma posição a perder tanto o que deve fazer o investidor fundamental?

R: Com calma, analisar os dados divulgados e ver se, através deles, se podia induzir alguma alteração estrutural do negócio que pudesse justificar a correcção ocorrida. Não era o caso. Evidentemente, que a empresa sofreria algumas contrariedades de curto-prazo mas o contexto de crescimento de longo prazo mantinha-se/mantém-se intacto.

Resultado: A empresa estava a um PER ainda mais atractivo (cerca de 9.5) e portanto decidi reforçar. Reforcei a 19.41, a 20.22 e a 21.29 construindo uma posição de aproximadamente $16.000. Por essa altura começam a surgir rumores de que a empresa poderia a vir ser adquirida por um dos maiores banco dos USA.

A 30/06 o Bank of America anunciou o acordo para aquisição da MBNA com um prémio superior a 30%. Os seus administradores demonstraram o seu entusiasmo por uma aquisição de $35 biliões de dólares numa empresa com uma larga base de clientes, com enorme potencial de crescimento e uma excelente administração.

É claro que assim dá gosto analisar fundamentais. Mas é aqui que eu chamo a atenção do potencial investidor fundamental. Não nos podemos deixar iludir pois esta foi uma situação extraordinária. Caso a OPA não tivesse ocorrido teria de esperar muito mais tempo antes de a ver atingir aqueles preços. É preciso calma, acreditar nos fundamentais e esperar.

Com a venda da posição deste título abri uma nova numa concorrente da MBNA: a Capital One Financial. Também se fala que poderá vir a ser comprada, mas isso pouco interessa. Não abro posições com base em rumores. Tenho é confiança nos fundamentais.

Ficam os dados da MBNA, o gráfico e os movimentos no título. No final, deixo também um quadro com alguns dados comparativos de empresas do sector onde se pode ver, actualmente, a boa posição da Capital One Financial.

Este caso é, ao mesmo tempo, um excelente exemplo do que procuro demonstar com este método de investimento mas, também, uma situação que pode iludir os investidores mais ansiosos.

O gráfico da cotação vinha variando entre 23.5 e os 29 e face ao PER que estava na altura (cerca de 11) esperei que viesse retestar o suporte para entrar. Assim aconteceu, quando entrei no dia 18/04, precisamente nos 23.5 com $5000. Exactamente passados 3 dias, na divulgação de resultados da empresa, ela anuncia que as perspectivas de crescimento de resultados para os próximos trimestres serão abaixo do previsto, uma vez que muito do crédito concedido estava a ser, extraordinariamente, liquidado. As acções caíram mais de 18%.

Nesta altura com uma posição a perder tanto o que deve fazer o investidor fundamental?

R: Com calma, analisar os dados divulgados e ver se, através deles, se podia induzir alguma alteração estrutural do negócio que pudesse justificar a correcção ocorrida. Não era o caso. Evidentemente, que a empresa sofreria algumas contrariedades de curto-prazo mas o contexto de crescimento de longo prazo mantinha-se/mantém-se intacto.

Resultado: A empresa estava a um PER ainda mais atractivo (cerca de 9.5) e portanto decidi reforçar. Reforcei a 19.41, a 20.22 e a 21.29 construindo uma posição de aproximadamente $16.000. Por essa altura começam a surgir rumores de que a empresa poderia a vir ser adquirida por um dos maiores banco dos USA.

A 30/06 o Bank of America anunciou o acordo para aquisição da MBNA com um prémio superior a 30%. Os seus administradores demonstraram o seu entusiasmo por uma aquisição de $35 biliões de dólares numa empresa com uma larga base de clientes, com enorme potencial de crescimento e uma excelente administração.

É claro que assim dá gosto analisar fundamentais. Mas é aqui que eu chamo a atenção do potencial investidor fundamental. Não nos podemos deixar iludir pois esta foi uma situação extraordinária. Caso a OPA não tivesse ocorrido teria de esperar muito mais tempo antes de a ver atingir aqueles preços. É preciso calma, acreditar nos fundamentais e esperar.

Com a venda da posição deste título abri uma nova numa concorrente da MBNA: a Capital One Financial. Também se fala que poderá vir a ser comprada, mas isso pouco interessa. Não abro posições com base em rumores. Tenho é confiança nos fundamentais.

Ficam os dados da MBNA, o gráfico e os movimentos no título. No final, deixo também um quadro com alguns dados comparativos de empresas do sector onde se pode ver, actualmente, a boa posição da Capital One Financial.

quarta-feira, agosto 31, 2005

Análise Pfizer

Más notícias no sector e na própria acção têm castigado a cotação levando-a a valores de 1998 e a PERs mínimos dos últimos 10 anos!

A retirado do mercado de seu medicamento Celabrex bem como o desafio dos medicamentos genéricos têm pressionado este negócio de excelentes rentabilidades e crescimentos de resultados.

Ficam os dados fundamentais aos quais adicionei uma avaliação do seu valor intrínseco recorrendo a uma calculadora da SmatMoney que podem encontrar em http://www.smartmoney.com/pricecheck/index.cfm (Basta digitar o código do título).

A retirado do mercado de seu medicamento Celabrex bem como o desafio dos medicamentos genéricos têm pressionado este negócio de excelentes rentabilidades e crescimentos de resultados.

Ficam os dados fundamentais aos quais adicionei uma avaliação do seu valor intrínseco recorrendo a uma calculadora da SmatMoney que podem encontrar em http://www.smartmoney.com/pricecheck/index.cfm (Basta digitar o código do título).

quarta-feira, agosto 10, 2005

Análise Anheuser-Busch

Maior cervejeira do mundo, dona de marcas líder como Budweiser. Um ano mais fraco nas vendas está a castigar a cotação. Estão a perder vendas para outras bebidas como o vinho. Fala-se dum efeito "SideWays", o filme de Alexander Payne nomeado para os óscares 2005 e que tem como pano de fundo o mundo dos vinhos.

Agora eu pergunto. Acham que este efeito conjuntural de curto-prazo vai ter algum efeito estrutural de longo-prazo no negócio de rentabilidades excelentes e com marcas muito fortes da Anheuser-Busch?

A empresa está a transaccionar com um PER de 17, o mais baixo dos últimos 9 anos!

A empresa tem um suporte relevante nos 44.5-45 que foi quebrado na apresentação de resultados do dia 27/07/2005. Já tenho uma boa posição no título da ordem dos $5.000. Abaixo dos 44.5 só reforço se for aos 41.5.

É verdade! O Warren Buffet anda a comprar disto. Anunciou-o em 21/04/2005.

Fica a análise fundamental, a técnica e os movimentos efectuados no título.

+ Dados Fundamentais em www.Reuters.com (NOTA: Vão ter é que se registar - gratuitamente - no site. Mas vão ver que vale a pena):

Profile - Descrição mais pormenorizada da empresa http://www.investor.reuters.com/CompanyOverview.aspx?ticker=BUD&target=%2fstocks%2fquickinfo%2fcompanyprofile%2foverview

Ratios - Comparação de Múltiplos / Taxas de Crescimento / Rentabilidades / Rácios de Dívida com Sector / Indústria / S&P

http://www.investor.reuters.com/MG.aspx?ticker=BUD.N&target=%2fstocks%2ffinancialinfo%2fratios%2fvaluation

PS: Nos últimos dias comprei um pouco ($1.000) de Pfizer e de Avon. Hoje vendi $1.000 de Lincare na resistência dos 43.5.

Agora eu pergunto. Acham que este efeito conjuntural de curto-prazo vai ter algum efeito estrutural de longo-prazo no negócio de rentabilidades excelentes e com marcas muito fortes da Anheuser-Busch?

A empresa está a transaccionar com um PER de 17, o mais baixo dos últimos 9 anos!

A empresa tem um suporte relevante nos 44.5-45 que foi quebrado na apresentação de resultados do dia 27/07/2005. Já tenho uma boa posição no título da ordem dos $5.000. Abaixo dos 44.5 só reforço se for aos 41.5.

É verdade! O Warren Buffet anda a comprar disto. Anunciou-o em 21/04/2005.

Fica a análise fundamental, a técnica e os movimentos efectuados no título.

+ Dados Fundamentais em www.Reuters.com (NOTA: Vão ter é que se registar - gratuitamente - no site. Mas vão ver que vale a pena):

Profile - Descrição mais pormenorizada da empresa http://www.investor.reuters.com/CompanyOverview.aspx?ticker=BUD&target=%2fstocks%2fquickinfo%2fcompanyprofile%2foverview

Ratios - Comparação de Múltiplos / Taxas de Crescimento / Rentabilidades / Rácios de Dívida com Sector / Indústria / S&P

http://www.investor.reuters.com/MG.aspx?ticker=BUD.N&target=%2fstocks%2ffinancialinfo%2fratios%2fvaluation

PS: Nos últimos dias comprei um pouco ($1.000) de Pfizer e de Avon. Hoje vendi $1.000 de Lincare na resistência dos 43.5.

segunda-feira, agosto 01, 2005

Análise Harley-Davidson

Quem não conhece esta marca? Uma empresa de rentabilidades impressionantes e de crescimento de resultados galopantes. No dia do anúncio de resultados (13/04) dilvulgou uma redução da produção de motos para o ano e foi castigada por uns severos 18%/19%. Óptimo. Ficou a preços apetitosos relativamente ao seu valor intrínseco.

Esperei pelo momento técnico ideal que aconteceu numa ruptura com volume em alta de um triângulo ascendente. Como tem um gap por fechar ainda possui um grande caminho a percorrer.

Fica a análise fundamental, a técnica e os movimentos efectuados no título.

Esperei pelo momento técnico ideal que aconteceu numa ruptura com volume em alta de um triângulo ascendente. Como tem um gap por fechar ainda possui um grande caminho a percorrer.

Fica a análise fundamental, a técnica e os movimentos efectuados no título.

quinta-feira, julho 28, 2005

Análise Biomet

Uma excelente empresa com grandes perspectivas futuras afectada por questões técnicas de curto prazo e notícias negativas no que diz respeito a eventuais aliciamentos, já negados pela empresa, de médicos para subscrição dos seus produtos. Representa praticamente 10% da carteira e espero mantê-la e às suas rentabilidades por muito tempo.

Fica a análise fundamental, a técnica e os movimentos efectuados no título.

PS: Continuo a reforçar na Timberland (na zona de suporte dos 34) e vendi um pouco de AIG. Amanhã volto a publicar a carteira actualizada.

Fica a análise fundamental, a técnica e os movimentos efectuados no título.

PS: Continuo a reforçar na Timberland (na zona de suporte dos 34) e vendi um pouco de AIG. Amanhã volto a publicar a carteira actualizada.

sábado, maio 21, 2005

Buffetology

O melhor livro sobre o método de investimento de Buffet elaborado com a colaboração de uma sua ex-nora.

Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett The Worlds

Americans are infatuated with the stock market. The number of households that own stock has increased from around 20 percent in the early 1980s to over 40 percent today. The market offers the hope of quick wealth and early retirement, and just about everyone who is in the market is looking for an edge, from sources such as CNBC and Wall Street Week to the Beardstown Ladies and "The Motley Fool." So it should be no surprise the most successful investor of our time--Warren Buffett--has been the subject of dozens of books and magazine articles. The value of Buffett's company, Berkshire Hathaway, has increased from $18 per share in 1965 to over $70,000 per share today. The interest in Buffett has spawned an approach to investing called "Buffettology," which is the subject of a book by the same name written by Buffett's former daughter-in-law, Mary Buffett.

In Buffettology, Mary Buffett, with the help of David Clark, details Warren Buffett's approach to investing. It's a style of investing based on the work of Benjamin Graham and one that requires a quality that most investors lack--discipline. Mary Buffett writes, "As you read through this book you will come to see that having a business perspective on investing is more about discipline than philosophy.... In short, other people's follies, brought on by fear and greed, will offer you, the investor, the opportunity to take advantage of their mistakes and benefit from the discipline of committing capital to investment only when it makes sense from a business perspective.... You will find that almost everything that relates to business perspective investing is alien to Wall Street folklore.

Buffettology examines Buffett's methods for valuing companies and selecting stocks--it even encourages you to buy a calculator and work through the valuation formulas that Buffett uses when researching companies to buy. The book not only serves as a useful guide to understanding how Buffett invests, it's an excellent primer to investing in stocks, whether you plan to become a Buffettologist or not. Highly recommended. --Harry C. Edwards, Business editor--This text refers to the Hardcover edition.

Review

Stevin Hoover Hoover Capital Management

Absolutely the best book ever written on Warren Buffett's investment methods.

Outros Livros:

The New Buffettology by Mary Buffet

The Warren Buffett Way, Second Edition by Robert G. Hagstrom

How to Think Like Benjamin Graham and Invest Like Warren Buffett by Lawrence A. Cunningham

The Warren Buffett Portfolio : Mastering the Power of the Focus Investment Strategy by Robert G. Hagstrom

The New Buffettology: How Warren Buffett Got and Stayed Rich in Markets Like This and How You Can Too! by David Clark

Trade Like Warren Buffett (Wiley Trading) by James Altucher

Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett The Worlds

Americans are infatuated with the stock market. The number of households that own stock has increased from around 20 percent in the early 1980s to over 40 percent today. The market offers the hope of quick wealth and early retirement, and just about everyone who is in the market is looking for an edge, from sources such as CNBC and Wall Street Week to the Beardstown Ladies and "The Motley Fool." So it should be no surprise the most successful investor of our time--Warren Buffett--has been the subject of dozens of books and magazine articles. The value of Buffett's company, Berkshire Hathaway, has increased from $18 per share in 1965 to over $70,000 per share today. The interest in Buffett has spawned an approach to investing called "Buffettology," which is the subject of a book by the same name written by Buffett's former daughter-in-law, Mary Buffett.

In Buffettology, Mary Buffett, with the help of David Clark, details Warren Buffett's approach to investing. It's a style of investing based on the work of Benjamin Graham and one that requires a quality that most investors lack--discipline. Mary Buffett writes, "As you read through this book you will come to see that having a business perspective on investing is more about discipline than philosophy.... In short, other people's follies, brought on by fear and greed, will offer you, the investor, the opportunity to take advantage of their mistakes and benefit from the discipline of committing capital to investment only when it makes sense from a business perspective.... You will find that almost everything that relates to business perspective investing is alien to Wall Street folklore.

Buffettology examines Buffett's methods for valuing companies and selecting stocks--it even encourages you to buy a calculator and work through the valuation formulas that Buffett uses when researching companies to buy. The book not only serves as a useful guide to understanding how Buffett invests, it's an excellent primer to investing in stocks, whether you plan to become a Buffettologist or not. Highly recommended. --Harry C. Edwards, Business editor--This text refers to the Hardcover edition.

Review

Stevin Hoover Hoover Capital Management

Absolutely the best book ever written on Warren Buffett's investment methods.

Outros Livros:

The New Buffettology by Mary Buffet

The Warren Buffett Way, Second Edition by Robert G. Hagstrom

How to Think Like Benjamin Graham and Invest Like Warren Buffett by Lawrence A. Cunningham

The Warren Buffett Portfolio : Mastering the Power of the Focus Investment Strategy by Robert G. Hagstrom

The New Buffettology: How Warren Buffett Got and Stayed Rich in Markets Like This and How You Can Too! by David Clark

Trade Like Warren Buffett (Wiley Trading) by James Altucher

A minha análise fundamental!

Aprendi finanças na Faculdade de Economia do Porto. Balanço, Demonstrações de Resultados, Cash Flows, Múltiplos de Mercado, ...

No entanto, toda essa matéria dada em série aos alunos só começou a fazer sentido quando comecei a vasculhar em livros e artigos (muito mais práticos do que os manuais da Faculdade) sobre o método de investimento fundamental utilizado por Warren Buffet (este inspirado pelos ensinamentos de Benjamin Graham). Aí tudo se simplicou na minha cabeça. Descobri um guia, uma linha de pensamento que me organizou e instituiu um método.

Nos próximos posts vou falar sobre esses ensinamentos...

No entanto, toda essa matéria dada em série aos alunos só começou a fazer sentido quando comecei a vasculhar em livros e artigos (muito mais práticos do que os manuais da Faculdade) sobre o método de investimento fundamental utilizado por Warren Buffet (este inspirado pelos ensinamentos de Benjamin Graham). Aí tudo se simplicou na minha cabeça. Descobri um guia, uma linha de pensamento que me organizou e instituiu um método.

Nos próximos posts vou falar sobre esses ensinamentos...

terça-feira, maio 17, 2005

Stock Market Lies

Stock Market Lies

By Richard Gibbons May 2, 2005

Value investors are independent thinkers. They don't need the crowd to validate their ideas, nor do they act contrarian simply for the sake of being different. While Sun Microsystems (Nasdaq: SUNW) and JDS Uniphase (Nasdaq: JDSU) were zooming up at the height of the tech bubble in the late 1990s, Warren Buffett was criticized as being out of touch with the realities of the new economy. Now that the bubble has popped, Buffett's company, Berkshire Hathaway, is close to all-time highs, while Sun and JDS Uniphase investors have been slaughtered.

Buffett wasn't avoiding technology just to be a contrarian. Berkshire's portfolio has piles of great businesses bought at reasonable prices, not just cheap businesses bought when nobody else wanted them. Companies like American Express (NYSE: AXP) and Moody's (NYSE: MCO) can hardly be considered cigar butts, but they've made Buffett wealthy nevertheless. Buffett's success can be attributed to well-reasoned purchases made within an investing framework based on value principles.

This approach sharply contrasts with most of the financial industry, which is why it is an interesting exercise to examine, from a value perspective, the disinformation that the financial industry pitches at investors every day.

"If you were out of the market for the best 30 days in the past decade, you would have lost money."

Mutual fund advisors often use this statistic to urge investors to stick with them for the long term, despite the fact that advisors themselves tend to be traders -- the typical managed mutual fund has an average turnover rate of 85%. But while being shocked and appalled at such hypocrisy is an entertaining hobby, it's also worthwhile to analyze the reasoning behind the claim.

The statistic is accurate: $10,000 invested in the S&P 500 a decade ago grew to almost $25,000 today (excluding dividends), while without the best 30 days, it would be worth only $7,700. But before making conclusions about market timing, consider the opposite statistic: If you were out of the market for the worst 30 days, you would have made $76,000. If the first statistic is saying that you should remain invested at all times, this statistic seems to be saying that trading to avoid bad days is critical. What gives?

Neither case is accurate. Rather, the statistic is used as propaganda to help fund companies pitch their funds and discourage investors from selling. There are many good reasons to be a long-term investor, including tax-free compounding, reduced expenses, and reduced risk. But this statistic is not a good reason.

What do these statistics mean to the individual investor? It's not clear, except that if you're a trader, some bad or good luck on a few select days could have very dramatic effects on your portfolio. But as a value investor, I think of some potential benefits of a margin of safety. By buying a stock at a discount to its intrinsic value, I'm likely to avoid the worst of the fallout on those worst 30 days, and my long-term performance should be superior.

"The trend is your friend."

This catchy one-liner reflects the momentum that stocks gather: Stocks going up tend to keep ascending, while stocks going down tend to keep falling. The logic driving the claim is a combination of psychology and faith. The psychology is that investors would prefer to buy a stock that's going up and therefore keep pushing it up. The faith is the belief that if something's going up, there must be some reason for it, so it will probably continue to do so.

This reasoning might work for day traders, but it is quite bizarre from a value perspective. First, if a stock is going up, then, all else being equal, it becomes less attractive to value investors because it is approaching -- or exceeding -- its intrinsic value. The upside is less and the downside is greater. Conversely, a stock going down becomes more attractive because both the margin of safety and potential return increase. Value investors love to buy goods when they're on sale. So the trend isn't a value investor's friend, but actually an enemy, like an evil maharaja, Jar Jar Binks, or a berserk koala.

The value investor's true friends are competitive advantages and a margin of safety. Competitive advantages ensure that the company will outperform others for a long time, while a margin of safety dramatically reduces the chance that the value investor will suffer significant losses.

"Run your profits, cut your losses."

This expression is the bedfellow of the "friendly trend" from above -- and with such a nickname, it has many bedfellows, including "buy high, sell higher" and "don't catch a falling knife." It means that if you're making money on an investment, don't sell quickly, but if you're losing money, then run for the hills. Frequently, it's implemented with some sort of stop-loss rule, such as "sell any stock that falls by 10%." The idea holds some appeal, since if you have the same number of winners and losers, but make more on the winners, then you will come out ahead.

However, this reasoning trips over the same stumbling block as momentum investing: It ignores valuation. If a stock has fallen 10% below your purchase price, that does not imply anything about the intrinsic value of the company. If the stock is down on negative news that decreases your estimate of intrinsic value, such as Merck (NYSE: MRK) after its Vioxx withdrawal, or Doral (NYSE: DRL) taking a hit to its balance sheet and changing its business model because of troubles with interest-only strips, then it makes sense to reevaluate the position.

But if the stock falls with no fundamental change, or falls further than is justified by the change in the intrinsic value, then a value investor would be more inclined to increase the position than decrease it. After all, the upside has become bigger and the downside smaller. The intrinsic value of Martha Stewart Living Omnimedia (NYSE: MSO) fell when Martha Stewart went to court, but the share price declined far more than the intrinsic value. Now that the homemaker's troubles seem to be behind her, shareholders who bought during the trial have tripled their investment.

"The market is always right."

Traders say this when the market is not doing what they expect it to do. It generally means that the trader believes his or her reasoning to be incorrect, since the market isn't acting as planned. Consequently, the traders should cut their losses. I love this expression because it's so pessimistic. It reminds me of Eeyore, blue-grey donkey and portfolio manager: "I was just kind of guessing where the stock was going anyway, and I was wrong. Oh, well."

Value investors think this expression is quaint. The market is right occasionally, but overall it tends to be pretty bipolar, with individual stocks priced both above and below intrinsic value. Really, if a stock is priced at less than the discounted value of its expected future returns, then the market is wrong. In such cases, value investors are able to make extraordinary profits both from long-term growth in the business and from the stock returning to intrinsic value. In fact, identifying such stocks is Motley Fool Inside Value's primary goal.

In conclusion

Many common investing expressions don't hold up when examined from a value perspective. However, this can be a great thing, as those who do believe in such maxims may push stocks away from intrinsic values, providing an opportunity for value investors to profit.

By Richard Gibbons May 2, 2005

Value investors are independent thinkers. They don't need the crowd to validate their ideas, nor do they act contrarian simply for the sake of being different. While Sun Microsystems (Nasdaq: SUNW) and JDS Uniphase (Nasdaq: JDSU) were zooming up at the height of the tech bubble in the late 1990s, Warren Buffett was criticized as being out of touch with the realities of the new economy. Now that the bubble has popped, Buffett's company, Berkshire Hathaway, is close to all-time highs, while Sun and JDS Uniphase investors have been slaughtered.

Buffett wasn't avoiding technology just to be a contrarian. Berkshire's portfolio has piles of great businesses bought at reasonable prices, not just cheap businesses bought when nobody else wanted them. Companies like American Express (NYSE: AXP) and Moody's (NYSE: MCO) can hardly be considered cigar butts, but they've made Buffett wealthy nevertheless. Buffett's success can be attributed to well-reasoned purchases made within an investing framework based on value principles.

This approach sharply contrasts with most of the financial industry, which is why it is an interesting exercise to examine, from a value perspective, the disinformation that the financial industry pitches at investors every day.

"If you were out of the market for the best 30 days in the past decade, you would have lost money."

Mutual fund advisors often use this statistic to urge investors to stick with them for the long term, despite the fact that advisors themselves tend to be traders -- the typical managed mutual fund has an average turnover rate of 85%. But while being shocked and appalled at such hypocrisy is an entertaining hobby, it's also worthwhile to analyze the reasoning behind the claim.

The statistic is accurate: $10,000 invested in the S&P 500 a decade ago grew to almost $25,000 today (excluding dividends), while without the best 30 days, it would be worth only $7,700. But before making conclusions about market timing, consider the opposite statistic: If you were out of the market for the worst 30 days, you would have made $76,000. If the first statistic is saying that you should remain invested at all times, this statistic seems to be saying that trading to avoid bad days is critical. What gives?

Neither case is accurate. Rather, the statistic is used as propaganda to help fund companies pitch their funds and discourage investors from selling. There are many good reasons to be a long-term investor, including tax-free compounding, reduced expenses, and reduced risk. But this statistic is not a good reason.

What do these statistics mean to the individual investor? It's not clear, except that if you're a trader, some bad or good luck on a few select days could have very dramatic effects on your portfolio. But as a value investor, I think of some potential benefits of a margin of safety. By buying a stock at a discount to its intrinsic value, I'm likely to avoid the worst of the fallout on those worst 30 days, and my long-term performance should be superior.

"The trend is your friend."

This catchy one-liner reflects the momentum that stocks gather: Stocks going up tend to keep ascending, while stocks going down tend to keep falling. The logic driving the claim is a combination of psychology and faith. The psychology is that investors would prefer to buy a stock that's going up and therefore keep pushing it up. The faith is the belief that if something's going up, there must be some reason for it, so it will probably continue to do so.

This reasoning might work for day traders, but it is quite bizarre from a value perspective. First, if a stock is going up, then, all else being equal, it becomes less attractive to value investors because it is approaching -- or exceeding -- its intrinsic value. The upside is less and the downside is greater. Conversely, a stock going down becomes more attractive because both the margin of safety and potential return increase. Value investors love to buy goods when they're on sale. So the trend isn't a value investor's friend, but actually an enemy, like an evil maharaja, Jar Jar Binks, or a berserk koala.

The value investor's true friends are competitive advantages and a margin of safety. Competitive advantages ensure that the company will outperform others for a long time, while a margin of safety dramatically reduces the chance that the value investor will suffer significant losses.

"Run your profits, cut your losses."

This expression is the bedfellow of the "friendly trend" from above -- and with such a nickname, it has many bedfellows, including "buy high, sell higher" and "don't catch a falling knife." It means that if you're making money on an investment, don't sell quickly, but if you're losing money, then run for the hills. Frequently, it's implemented with some sort of stop-loss rule, such as "sell any stock that falls by 10%." The idea holds some appeal, since if you have the same number of winners and losers, but make more on the winners, then you will come out ahead.

However, this reasoning trips over the same stumbling block as momentum investing: It ignores valuation. If a stock has fallen 10% below your purchase price, that does not imply anything about the intrinsic value of the company. If the stock is down on negative news that decreases your estimate of intrinsic value, such as Merck (NYSE: MRK) after its Vioxx withdrawal, or Doral (NYSE: DRL) taking a hit to its balance sheet and changing its business model because of troubles with interest-only strips, then it makes sense to reevaluate the position.

But if the stock falls with no fundamental change, or falls further than is justified by the change in the intrinsic value, then a value investor would be more inclined to increase the position than decrease it. After all, the upside has become bigger and the downside smaller. The intrinsic value of Martha Stewart Living Omnimedia (NYSE: MSO) fell when Martha Stewart went to court, but the share price declined far more than the intrinsic value. Now that the homemaker's troubles seem to be behind her, shareholders who bought during the trial have tripled their investment.

"The market is always right."

Traders say this when the market is not doing what they expect it to do. It generally means that the trader believes his or her reasoning to be incorrect, since the market isn't acting as planned. Consequently, the traders should cut their losses. I love this expression because it's so pessimistic. It reminds me of Eeyore, blue-grey donkey and portfolio manager: "I was just kind of guessing where the stock was going anyway, and I was wrong. Oh, well."

Value investors think this expression is quaint. The market is right occasionally, but overall it tends to be pretty bipolar, with individual stocks priced both above and below intrinsic value. Really, if a stock is priced at less than the discounted value of its expected future returns, then the market is wrong. In such cases, value investors are able to make extraordinary profits both from long-term growth in the business and from the stock returning to intrinsic value. In fact, identifying such stocks is Motley Fool Inside Value's primary goal.

In conclusion

Many common investing expressions don't hold up when examined from a value perspective. However, this can be a great thing, as those who do believe in such maxims may push stocks away from intrinsic values, providing an opportunity for value investors to profit.

Profit From Panic

By Richard Gibbons

April 15, 2005

The mission of Motley Fool Inside Value is simple: We want to find companies trading at prices less than their fair value. In some cases, companies are below fair value simply because the market has failed to appreciate the sustainability of a company's competitive advantage. At other times, companies fall below their fair value during a crisis, when panicked investors flee.

The latter case has the potential for quick returns, but also comes with greater risk. When looking at companies in crises, such as AIG and Doral Financial (NYSE: DRL) right now, it can be challenging distinguishing between a company just suffering a flesh wound and one on its deathbed.

When you do identify a potential turnaround, it can be quite lucrative. Consider Martha Stewart Living Omnimedia (NYSE: MSO). When Martha Stewart's insider-trading fiasco first made the news, it was possible to pick up shares at less than $7. These shares traded above $35 this year, for a pleasant 400% return. Much larger multibaggers over the course of years are easily within reach. The difficulty, though, is determining who will survive and prosper. With that goal in mind, here are some of the issues I consider when trying to profit from panic.

LiquidityIn a crisis, cash gives a company the time and flexibility to survive a rough patch and reorganize its business. It's critical to get a good feeling for the degree to which cash on the balance sheet and future cash inflows are able to cover future cash outflows. Of course, the event causing the crisis often reduces operating cash flows, so using historical cash flow numbers can be deceptive. Instead, start with historical numbers and come up with a pessimistic approximation of the extent to which the negative event will impact cash flows, and how much cash outflows can be reduced over the short term, through, say, delaying capital expenditures.

If the company is close to the edge, there's a good chance it will topple over, so it should be avoided.

Even if the cash flow looks good, another liquidity issue to consider is debt. Even if it seems clear to shareholders that the company has enough cash flow to survive, banks and other lenders can be skittish. So it's a good idea to examine absolute levels of debt and future debt maturities. If the company is highly leveraged, or a substantial portion of its debt is coming due in the next few years, then the company may be unable to roll that debt over to future maturities. Often, it's not the slow draining of cash resources that leads to bankruptcy, but rather a large debt maturity that the company is unable to roll over or repay.

Asset strengthWhen it comes to turnarounds, the balance sheet can count more than the income statement. I've already talked about debt. Another factor to consider is the strength of the assets, because all assets are not equal. Cash is the best asset, since it gives maximum flexibility.

Other good assets include securities and non-depreciating physical assets that can potentially be sold, such as real estate. Because of the rules of accounting, real estate can be particularly strong because it may be listed on the balance sheet at significantly less than its present value.

However, there are also bad assets that generally cannot easily be sold or generate cash. Such assets include goodwill and tax assets. Goodwill is useless because it's intangible, while tax assets can only be converted into cash when the company has operating profits, generally after the crisis has passed. So when considering a company's survival prospects, it's best to heavily discount the value of these assets.

The competitive positionPreferably, we're buying the beaten-down company not just for its assets but also for its future operating performance. Ideally, the company is suffering from temporary bad news, but its long-term competitive position is intact. Maybe the company will show poor results for a year or two, but is likely to prosper after that time. Or perhaps the company has suffered a permanent setback but is still strong enough to be a viable business.

In late 2001, terrorism fears hit the travel industry. At the time, people were talking about how far the airlines would fall, and which airlines would survive. But really, the travel recovery play wasn't in airlines. Sure, people who perfectly timed AMR's (NYSE: AMR) crisis in 2003 could have earned 500% returns. But they would have been assuming a lot of risk buying into an extremely volatile industry with fleeting competitive advantages.

Instead, the simple and safe travel industry play was the hotels. Hotels have competitive advantages both in terms of location and brand. Plus, hotels often own real estate that can provide a cushion to help avoid liquidity concerns. A September 2001 purchase of Starwood Hotels and Resorts (NYSE: HOT) or Hilton Hotels (NYSE: HLT), two of the largest hoteliers, would have returned 100% within a year, or 200% had you decided to hold until now.

Bringing it togetherA good example of all these issues is National Health Investors (NYSE: NHI), a REIT that primarily owns nursing homes. As you can see in this chart, National Heath Investors was flying along quite happily when it hit the perfect storm. The Balanced Budget Act of 1997 cut Medicare revenues to its nursing home operators, the companies that lease National Health Investors' buildings. Consequently, many operators went bankrupt. Plus, it was affected by overbuilding and labor shortages. Finally, lawsuits in Florida were destroying the business there.

Confronted with these challenges, National Health collapsed like Mr. Bean sparring with Evander Holyfield. I became interested, and bought some at $15. This was a wee bit early, since it cratered below $5 when the company discontinued its dividend only six months later. But this wasn't a technology company. It had solid real estate assets in a time of falling interest rates.

Cash flow was still positive. The entire industry was unlikely to vanish: Somehow, someone would take care of the elderly. So I bought more at $5, and it started to look like the industry was recovering.

But National Health owed money to the banks. And the banks panicked, demanding repayment. So National Health was forced to sell convertible preferreds at a time when the stock was low, diluting existing shareholders. I bought more in the $6 range. Cash flow was still good, nursing home operators were coming out of bankruptcy, and the balance sheet, never really overleveraged to begin with, now looked quite clean. It was difficult to see how National Health could fail.

Now, four years later, the stock is trading around $25. That's lower than it would be if it hadn't been forced to issue the convertible, but it's still a decent return. For months, value investors bought in the $6 range, and those investors have seen a 400% return. What's more, since National Heath has a $1.80 dividend, investors at $6 are now seeing an annual dividend of 30% on their original investment. I sold out at $22.

The keys in this case were that cash flow was positive, leverage was reasonable, the assets were strong, and there were signs that the industry would turn around. Even then, the debt maturity hurt shareholders significantly, because nobody wanted to lend to companies in the sector. This is why, when analyzing these turnaround situations, it is critical to consider debt maturities.ConclusionEvaluating these factors can help you find and identify turnaround plays that lead to extraordinary profits. For instance, in 2002, both Philip Durell, Inside Value's chief analyst, and I independently recognized that Providian Financial (NYSE: PVN) had a decent chance of rebounding, and we both bought well under $5. It's now around $17. If you want to learn about what Philip sees as the great value plays right now, and see all of his historical recommendations, a free 30-day trial is available. Or, for a limited time, Philip is offering Inside Value at a 25% discount to the regular price. To find out more, click here.

April 15, 2005

The mission of Motley Fool Inside Value is simple: We want to find companies trading at prices less than their fair value. In some cases, companies are below fair value simply because the market has failed to appreciate the sustainability of a company's competitive advantage. At other times, companies fall below their fair value during a crisis, when panicked investors flee.

The latter case has the potential for quick returns, but also comes with greater risk. When looking at companies in crises, such as AIG and Doral Financial (NYSE: DRL) right now, it can be challenging distinguishing between a company just suffering a flesh wound and one on its deathbed.

When you do identify a potential turnaround, it can be quite lucrative. Consider Martha Stewart Living Omnimedia (NYSE: MSO). When Martha Stewart's insider-trading fiasco first made the news, it was possible to pick up shares at less than $7. These shares traded above $35 this year, for a pleasant 400% return. Much larger multibaggers over the course of years are easily within reach. The difficulty, though, is determining who will survive and prosper. With that goal in mind, here are some of the issues I consider when trying to profit from panic.

LiquidityIn a crisis, cash gives a company the time and flexibility to survive a rough patch and reorganize its business. It's critical to get a good feeling for the degree to which cash on the balance sheet and future cash inflows are able to cover future cash outflows. Of course, the event causing the crisis often reduces operating cash flows, so using historical cash flow numbers can be deceptive. Instead, start with historical numbers and come up with a pessimistic approximation of the extent to which the negative event will impact cash flows, and how much cash outflows can be reduced over the short term, through, say, delaying capital expenditures.

If the company is close to the edge, there's a good chance it will topple over, so it should be avoided.

Even if the cash flow looks good, another liquidity issue to consider is debt. Even if it seems clear to shareholders that the company has enough cash flow to survive, banks and other lenders can be skittish. So it's a good idea to examine absolute levels of debt and future debt maturities. If the company is highly leveraged, or a substantial portion of its debt is coming due in the next few years, then the company may be unable to roll that debt over to future maturities. Often, it's not the slow draining of cash resources that leads to bankruptcy, but rather a large debt maturity that the company is unable to roll over or repay.

Asset strengthWhen it comes to turnarounds, the balance sheet can count more than the income statement. I've already talked about debt. Another factor to consider is the strength of the assets, because all assets are not equal. Cash is the best asset, since it gives maximum flexibility.

Other good assets include securities and non-depreciating physical assets that can potentially be sold, such as real estate. Because of the rules of accounting, real estate can be particularly strong because it may be listed on the balance sheet at significantly less than its present value.

However, there are also bad assets that generally cannot easily be sold or generate cash. Such assets include goodwill and tax assets. Goodwill is useless because it's intangible, while tax assets can only be converted into cash when the company has operating profits, generally after the crisis has passed. So when considering a company's survival prospects, it's best to heavily discount the value of these assets.

The competitive positionPreferably, we're buying the beaten-down company not just for its assets but also for its future operating performance. Ideally, the company is suffering from temporary bad news, but its long-term competitive position is intact. Maybe the company will show poor results for a year or two, but is likely to prosper after that time. Or perhaps the company has suffered a permanent setback but is still strong enough to be a viable business.

In late 2001, terrorism fears hit the travel industry. At the time, people were talking about how far the airlines would fall, and which airlines would survive. But really, the travel recovery play wasn't in airlines. Sure, people who perfectly timed AMR's (NYSE: AMR) crisis in 2003 could have earned 500% returns. But they would have been assuming a lot of risk buying into an extremely volatile industry with fleeting competitive advantages.

Instead, the simple and safe travel industry play was the hotels. Hotels have competitive advantages both in terms of location and brand. Plus, hotels often own real estate that can provide a cushion to help avoid liquidity concerns. A September 2001 purchase of Starwood Hotels and Resorts (NYSE: HOT) or Hilton Hotels (NYSE: HLT), two of the largest hoteliers, would have returned 100% within a year, or 200% had you decided to hold until now.

Bringing it togetherA good example of all these issues is National Health Investors (NYSE: NHI), a REIT that primarily owns nursing homes. As you can see in this chart, National Heath Investors was flying along quite happily when it hit the perfect storm. The Balanced Budget Act of 1997 cut Medicare revenues to its nursing home operators, the companies that lease National Health Investors' buildings. Consequently, many operators went bankrupt. Plus, it was affected by overbuilding and labor shortages. Finally, lawsuits in Florida were destroying the business there.

Confronted with these challenges, National Health collapsed like Mr. Bean sparring with Evander Holyfield. I became interested, and bought some at $15. This was a wee bit early, since it cratered below $5 when the company discontinued its dividend only six months later. But this wasn't a technology company. It had solid real estate assets in a time of falling interest rates.

Cash flow was still positive. The entire industry was unlikely to vanish: Somehow, someone would take care of the elderly. So I bought more at $5, and it started to look like the industry was recovering.

But National Health owed money to the banks. And the banks panicked, demanding repayment. So National Health was forced to sell convertible preferreds at a time when the stock was low, diluting existing shareholders. I bought more in the $6 range. Cash flow was still good, nursing home operators were coming out of bankruptcy, and the balance sheet, never really overleveraged to begin with, now looked quite clean. It was difficult to see how National Health could fail.

Now, four years later, the stock is trading around $25. That's lower than it would be if it hadn't been forced to issue the convertible, but it's still a decent return. For months, value investors bought in the $6 range, and those investors have seen a 400% return. What's more, since National Heath has a $1.80 dividend, investors at $6 are now seeing an annual dividend of 30% on their original investment. I sold out at $22.

The keys in this case were that cash flow was positive, leverage was reasonable, the assets were strong, and there were signs that the industry would turn around. Even then, the debt maturity hurt shareholders significantly, because nobody wanted to lend to companies in the sector. This is why, when analyzing these turnaround situations, it is critical to consider debt maturities.ConclusionEvaluating these factors can help you find and identify turnaround plays that lead to extraordinary profits. For instance, in 2002, both Philip Durell, Inside Value's chief analyst, and I independently recognized that Providian Financial (NYSE: PVN) had a decent chance of rebounding, and we both bought well under $5. It's now around $17. If you want to learn about what Philip sees as the great value plays right now, and see all of his historical recommendations, a free 30-day trial is available. Or, for a limited time, Philip is offering Inside Value at a 25% discount to the regular price. To find out more, click here.

Selecting Stocks Using ROE

Have you ever wondered why two similar companies can have vastly different prospects and returns? You could look at earnings per share, but knowing if a company is underperforming is less important than figuring out why. Breaking apart return on equity can determine that a company's operations are improving before the market notices.

By Bill Mann (TMF Otter)

April 28, 2004

Ever wonder why some companies succeed while similar companies fail to generate the same returns for shareholders? One of the key elements is a company's ability to turn the shareholder equity it holds into profits. It's one of the key elements that Mathew Emmert looks for in his dividend-paying stocks featured in Motley Fool Income Investor. In fact, it's an element that every investor should keep in the ol' toolbox for evaluating securities.

It doesn't get the same treatment as earnings per share, it doesn't gain much cult status like free cash flow, and you'll never, ever hear the folks on Bubblevision using the term. But return on equity (ROE) matters. It shows how good a company is at generating money based on the retained shareholder equity, also known as money that the company could return to you. This is an important number for dividend payers as it shows how well the company is generating returns for the next dividend. A consistently low ROE is a sign that the company's management isn't effectively deploying the resources at its command.

Moreover, relative return on equity within an industry can tell investors which companies are well run, and which are not. Ever wonder why Ralph Lauren (NYSE: RL) was such a lousy investment for so many years even though everyone seemed to have one or two pieces of Polo clothing in their closets? Look no farther than a chronically anemic ROE.

The basic calculation for return on equity is dazzlingly simple: net income divided by shareholders' equity (book value). But this calculation hides some more nuanced information that not only indicates a company is generating poor returns, but also why. The return on equity calculation, as simple as it appears, is actually a combination of several critical components relating to profit margins, asset turnover, debt, and debt servicing. Break this calculation down into its elements and you'll get an astounding amount of information about a company, its trends, and its performance relative to its competition.

Permit me to demonstrate by looking at two similar companies: American Eagle Outfitters (Nasdaq: AEOS) and Abercrombie & Fitch (NYSE: ANF). American Eagle has 800 stores, Abercrombie 700. American Eagle's trailing 12-month revenues exceeded $1.5 billion, Abercrombie's $1.7 billion. These are not huge differences, and yet Abercrombie is valued 50% higher than American Eagle Outfitters. One hint why: Abercrombie & Fitch has an ROE exceeding 25%, while American Eagle Outfitters' is less than 10%.

Does this mean that the companies' book values are wide apart? Again, no -- they are quite close. Obviously, the return component for American Eagle is far inferior to that of Abercrombie. Let's dig in and figure out why. Keep in mind this formula for ROE: [(operating profit margin)(asset turnover) - (interest expense rate)](leverage)(tax retention rate).

Item 1. Operating profit marginSimple enough. By dividing EBIT (earnings before interest and taxes) by sales, you find out how much money the company made from operating activities before the taxman and the noteholders get their lucre, and you want to see how much in revenues it took to generate this amount. A company could sell billions of dollars' worth of product, but if its expenses consistently equal or exceed its revenues, it's more like a turnstile than a business. Right out of the gate, we can see a big discrepancy between our two case-study companies. Abercrombie has an operating profit margin of 19.4%, while American Eagle's is 6.9%. At those rates, it would take American Eagle nearly three times the sales to generate the same gross operating profit.

Item 2. Asset turnoverI love this measure -- it's where places like Costco (Nasdaq: COST), Claire's (NYSE: CLE), and Home Depot (NYSE: HD) really shine. Compared to the level of assets, how much in revenues did the company generate? So we use this formula: sales divided by average assets. (Note we're talking average assets, not the raw number at the end of the reporting period.) For American Eagle, the turnover is 1.89 times, while for Abercrombie it's 1.53 times, so American Eagle is actually better in this regard.

Item 3. Interest expense rateRemember, in Item 1 we backed out interest payments. That's because we want to be able to view leverage separately from operations. If a company is operating well but is simply drowning in debt, that would be useful information -- and if in future periods you notice the debt level dropping, you might have yourself an underappreciated stock. Stranger things have happened. What we're looking for here is how much interest the company is paying to maintain its asset base, so the formula is interest expense divided by assets. Abercrombie, rather than paying interest, generates it from the cash in the bank, so it actually has an interest expense rate of negative 0.3%. Ditto American Eagle, which comes in at minus 0.4% Nice.

Item 4. LeverageWait a minute, didn't we just get finished determining that neither company had any interest expenses? I guess that means we can scribble in a zero for both and move on, right? Not so fast. While neither had interest-bearing debt, both have plenty of operating, short-term leverage -- accrued expenses, accounts payable, even unredeemed gift cards. Still, this component's pretty simple to calculate. The formula is average assets divided by average shareholders' equity (remember the average part). American Eagle comes in at 1.31, while Abercrombie & Fitch is 1.37 times -- nearly identical.