Martin Zweig's 3 rules for picking stocks made him a legend. A similar system might make you money, too.

By

Harry DomashUnless you've been in the stock market for some time, you've probably never heard of Martin Zweig. Whether you have or not, I'm about to explain why it's a name worth remembering.

Almost two years ago, I

wrote an article with a stock-selection screen based on Zweig's strategies. The screen, run Aug. 11, 2004, turned up 17 stocks (excluding one that had already agreed to be acquired). Last week I checked on the performance of that portfolio.

Let's take a trip back in time. After its first year (as of Aug. 11, 2005), the portfolio had recorded an impressive 40% average return, compared to 15% for the S&P 500 (

$INX). But the story is even better than it sounds. Often, even though recording strong average returns, such portfolios usually include a few hefty losers. But, in this case, only two stocks dropped, with the biggest loss totaling only 11%.

After the first year, the portfolio lost steam. As of June 23, it had averaged a 43% return since its August 2004 inception, vs. 16% for the S&P 500. While the average return is still impressive, the results were more volatile, with bigger winners and more weak performers.

Given those results, the Zweig screen rates another look. But first, some background on Martin Zweig.

Although no longer in the limelight, Zweig, who has a Ph.D. in finance, is well known to market professionals for his disciplined approach to the market. His now-discontinued Zweig Forecast newsletter was ranked No. 1 for risk-adjusted returns over the 15 years that it was tracked by Hulbert Financial Digest.

He has examined the relationship between stock-market action and just about every conceivable economic or market indicator. In fact, he's credited with inventing the put-call ratio market sentiment indicator.

Zweig described the results of much of his research in his best-selling book, "

Martin Zweig's Winning on Wall Street," which is still in print. Much of the book covers Zweig's market-timing indicators, but he also details his stock selection strategies.

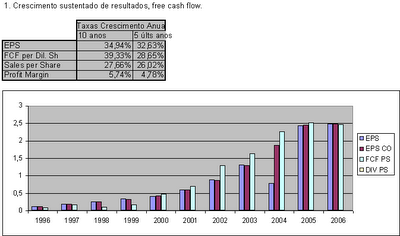

It's all in the numbersWhen it comes to picking stocks, Zweig is strictly a numbers guy. As he put it, "If a company can show nice consistent earnings, I don't care if it makes broomsticks or computer parts." Zweig focuses on three main criteria to pinpoint potential winners:

- Strong historical sales and earnings growth.

- A reasonable price.

- Strong price action relative to the market.

Zweig avoids stocks that have recently disappointed the market, and he doesn't like firms carrying high debt. While he doesn't want to overpay, Zweig is willing to pay more for strong stocks. Says Zweig, "buying on strength gives you an edge. You must pay a premium, but you increase the probability of being right." I'll fill in the details as I describe my screen for finding stocks meeting Zweig's criteria. (Click

here to go to MSN Money's Stock Screener.)

I'll start with sales and earnings growth, which are Zweig's top priorities.

Long-term growth Zweig wants to see consistent sales and earnings growth, going back four or five years. He considers 15% annual earnings growth acceptable, but prefers more. In his book, he gives numerous examples of stocks with 30% to 50% historical growth rates.

I require at least 15% average annual sales and earnings-per-share growth, measured over the past five years. Try increasing the minimums for either or both to 20% or even 25%, if you get too many hits.

Screening parameter: (5-year) Annual EPS Growth Rate >= 15%

Screening parameter: 5-Year Revenue Growth >= 15%

Recent growth Zweig avoids stocks with decelerating growth rates. He wants to see the most recent quarter's year-over-year EPS growth rate in the same ballpark as the long-term rate and, ideally, higher. However, he's not dogmatic and is willing to cut a stock a little slack, depending on conditions.

I require the most recent quarter's year-over-year EPS growth to be at least 75% of the long-term growth rate.

Screening Parameter: EPS Growth Qtr vs. Qtr >= 0.75* (5-year) Annual EPS Growth

The "depending on conditions" aspect requires a judgment call that you can't emulate in a screen. In my first Zweig article, I suggested "further checking" if the last quarter's EPS growth was near the 75% minimum.

To minimize that ambiguity, this time I'm also requiring that the most-recent quarter's year-over-year revenue growth be at least 85% of the long-term revenue growth rate. I figure that the problem is temporary if earnings stumble but revenue growth remains reasonably on track.

Screening Parameter: Revenue Growth Qtr vs. Qtr >= 0.85* (5-year) Annual Revenue Growth.

Revenues keep paceIdeally, earnings growth should track revenue growth. Revenues growing faster than earnings reflect declining profit margins, which signals that market conditions are becoming more competitive. Conversely, earnings growing faster than revenues says that the growth is coming from cost cutting rather than growing sales. If that's the case, eventually, the company will run out of places to cut costs, and earnings growth will slow.

So, while they won't track precisely, Zweig wants to see stocks with revenue and EPS long-term growth rates in the same ballpark. To emulate that condition, I require that long-term revenue must be at least 75% of earnings, and vice-versa.

Screening Parameter: (5-year) Annual EPS Growth Rate >= 0. 75*5-Year Revenue Growth

Screening Parameter: 5-Year Revenue Growth .+ 0.75*(5-year) Annual EPS Growth Rate

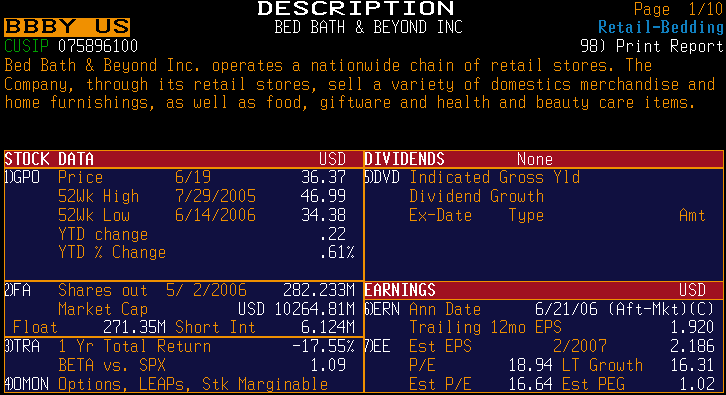

Don't overpayZweig doesn't want to overpay for stocks. He uses price-to-earnings ratios to measure valuation, but he doesn't set a hard-and-fast limit. Instead, his definition of overvalued depends on the market. In the examples in his book, Zweig accepts fast-growing companies with P/Es as much as 50% higher than the overall market.

I use the S&P 500 average P/E to represent the market, and reject stocks trading with P/Es more than 50% above the S&P.

Screening Parameter: P/E Ratio: Current <= 1.5*S&P 500 Average P/E Ratio: Current

Don't underpayAs much as he doesn't want to overpay, Zweig also avoids stocks that are too cheap. For him, very low P/Es signal that investors are abandoning ship, probably for good reason.

In his book, Zweig advised shunning stocks with P/Es below 5. Since his maximum P/E varies with the market, I used the same approach for defining "too cheap." When he wrote the book, a P/E of 5 equated to roughly 40% of the market average, so I set my minimum P/E at that level.

Screening Parameter: P/E Ratio: Current >= 0.4*S&P 500 Average P/E Ratio Current

Pick winnersZweig said he prefers stocks that are outperforming the market, although he will accept stocks "acting at least as well as the market."

Relative strength measures a stock's performance compared with the overall market over a specified timeframe. Zweig didn't mention a timeframe, but from his descriptions, I guessed that six months was in the ballpark. A 50 relative strength indicates a stock performing even with the market. Try increasing the minimum to 55 or 60 if you get too many hits.

Screening Parameter: 6-month Relative Strength>=50

Bad debtZweig said he prefers to avoid high-debt firms, but he wasn't specific. The debt-equity ratio, which is long-term debt divided by shareholders' equity, is the most-commonly used debt measure. Zero values signal no long-term debt, and the higher the ratio, the higher the debt.

Since Zweig was vague in his definition of high debt, and acceptable debt levels vary by industry, I rule out companies with debt-equity ratios higher than their industry average.

Screening Parameter: Debt to Equity Ratio <= Industry Average Debt to Equity Ratio

Don't be surprisedZweig avoided stocks that had recently disappointed the market by reporting earnings below forecasts. So, I rule out stocks with recent negative earnings surprises.

Screening parameter: Recent Qtr Surprise %>=0

Zweig also said he prefers stocks with some insider buying, or, at least minimal insider selling. In my original screen, I disqualified stocks where insider selling exceeded insider buying. However, I found that option exercises and related selling distorted the insider data. So, this time, I'm eliminating that requirement.

My screen turned up 15 stocks, with four of them in the energy sector. There was also an overweighting of regional banks, with two stocks in that category. Risk-averse investors should avoid duplicating stocks in the same industries. One of the stocks, Nicholas Financial (

NICK,

news,

msgs), was in my original screen from August 2004.

Zweig advises selling a stock if it drops roughly 15% below the purchase price. Otherwise, plan on holding these stocks for one year and then selling.

in

http://articles.moneycentral.msn.com/Investing/SimpleStrategies/MasterStrategistsSystemPicks15Gems.aspx?page=2