Busca pela medida ideal de valor e rentabilidade.

Artigo in Vale Tudo Investing.

quinta-feira, dezembro 27, 2007

terça-feira, outubro 30, 2007

sexta-feira, outubro 26, 2007

segunda-feira, outubro 22, 2007

sexta-feira, outubro 12, 2007

quinta-feira, outubro 11, 2007

Vídeos Morningstar

A Morningstar, na minha opinião o melhor serviço de avaliação de activos puramente value investor, disponibilizou os seus vídeos aconselhamento no Youtube. Vou deixar aqui alguns pois considero serem de enorme riqueza racional. A apresentador é o Pat Dorsey, analista chefe da Mornigstar, e que é uma espécie de Marcelo Rebelo de Sousa da apresentação de investimentos tirando a parte das fracas previsões...

Hoje fica o vídeo Your Edge on Wall Street: Time.

Hoje fica o vídeo Your Edge on Wall Street: Time.

quinta-feira, setembro 13, 2007

Sátira Contabilística de Ben Graham - 1936

U. S. STEEL ANNOUNCES SWEEPING MODERNIZATION SCHEME*

* An unpublished satire by Ben Graham, written in 1936 and given by the author to Warren Buffett in 1954 - In 1990 Letter to Berkshire Hathaway Shareholders, Appendix A.

Myron C. Taylor, Chairman of U. S. Steel Corporation, today announced the long awaited plan for completely modernizing the world's largest industrial enterprise. Contrary to expectations, no changes will be made in the company's manufacturing or selling policies. Instead, the bookkeeping system is to be entirely revamped. By adopting and further improving a number of modern accounting and financial devices the corporation's earning power will be amazingly transformed. Even under the subnormal conditions of 1935, it is estimated that the new bookkeeping methods would have yielded a reported profit of close to $50 per share on the common stock. The scheme of improvement is the result of a comprehensive survey made by Messrs. Price, Bacon, Guthrie & Colpitts; it includes the following six points:

1. Writing down of Plant Account to Minus $1,000,000,000.

2. Par value of common stock to be reduced to 1¢.

3. Payment of all wages and salaries in option warrants.

4. Inventories to be carried at $1.

5. Preferred Stock to be replaced by non-interest bearing bonds redeemable at 50% discount.

6. A $1,000,000,000 Contingency Reserve to be established.

The official statement of this extraordinary Modernization Plan follows in full:

The Board of Directors of U. S. Steel Corporation is pleased to announce that after intensive study of the problems arising from changed conditions in the industry, it has approved a comprehensive plan for remodeling the Corporation's accounting methods. A survey by a Special Committee, aided and abetted by Messrs. Price, Bacon, Guthrie & Colpitts, revealed that our company has lagged somewhat behind other American business enterprises in utilizing certain advanced bookkeeping methods, by means of which the earning power may be phenomenally enhanced without requiring any cash outlay or any changes in operating or sales conditions. It has been decided not only to adopt these newer methods, but to develop them to a still higher stage of perfection. The changes adopted by the Board may be summarized under six heads, as follows:

1. Fixed Assets to be written down to Minus $1,000,000,000.

Many representative companies have relieved their income accounts of all charges for depreciation by writing down their plant account to $1. The Special Committee points out that if their plants are worth only $1, the fixed assets of U. S. Steel Corporation are worth a good deal less than that sum. It is now a well-recognized fact that many plants are in reality a liability rather than an asset, entailing not only depreciation charges, but taxes, maintenance, and other expenditures. Accordingly, the Board has decided to extend the write-down policy initiated in the 1935 report, and to mark down the Fixed Assets from $1,338,522,858.96 to a round Minus $1,000,000,000.

The advantages of this move should be evident. As the plant wears out, the liability becomes correspondingly reduced. Hence, instead of the present depreciation charge of some $47,000,000 yearly there will be an annual appreciation credit of 5%, or $50,000,000. This will increase earnings by no less than $97,000,000 per annum.

2. Reduction of Par Value of Common Stock to 1¢, and

3. Payment of Salaries and Wages in Option Warrants.

Many corporations have been able to reduce their overhead expenses substantially by paying a large part of their executive salaries in the form of options to buy stock, which carry no charge against earnings. The full possibilities of this modern device have apparently not been adequately realized. The Board of Directors has adopted the following advanced form of this idea:

The entire personnel of the Corporation are to receive their compensation in the form of rights to buy common stock at $50 per share, at the rate of one purchase right for each $50 of salary and/or wages in their present amounts. The par value of the common stock is to be reduced to 1¢.

The almost incredible advantages of this new plan are evident from the following:

A. The payroll of the Corporation will be entirely eliminated, a saving of $250,000,000 per annum, based on 1935 operations.

B. At the same time, the effective compensation of all our employees will be increased severalfold. Because of the large earnings per share to be shown on our common stock under the new methods, it is certain that the shares will command a price in the market far above the option level of $50 per share, making the readily realizable value of these option warrants greatly in excess of the present cash wages that they will replace.

C. The Corporation will realize an additional large annual profit through the exercise of these warrants. Since the par value of the common stock will be fixed at 1¢, there will be a gain of $49.99 on each share subscribed for. In the interest of conservative accounting, however, this profit will not be included in the income account, but will be shown separately as a credit to Capital Surplus.

D. The Corporation's cash position will be enormously strengthened. In place of the present annual cash outgo of $250,000,000 for wages (1935 basis), there will be annual cash inflow of $250,000,000 through exercise of the subscription warrants for 5,000,000 shares of common stock. The Company's large earnings and strong cash position will permit the payment of a liberal dividend which, in turn, will result in the exercise of these option warrants immediately after issuance which, in turn, will further improve the cash position which, in turn, will permit a higher dividend rate -- and so on, indefinitely.

4. Inventories to be carried at $1.

Serious losses have been taken during the depression due to the necessity of adjusting inventory value to market. Various enterprises -- notably in the metal and cotton-textile fields -- have successfully dealt with this problem by carrying all or part of their inventories at extremely low unit prices. The U. S. Steel Corporation has decided to adopt a still more progressive policy, and to carry its entire inventory at $1. This will be effected by an appropriate write-down at the end of each year, the amount of said write-down to be charged to the Contingency Reserve hereinafter referred to.

The benefits to be derived from this new method are very great. Not only will it obviate all possibility of inventory depreciation, but it will substantially enhance the annual earnings of the Corporation. The inventory on hand at the beginning of the year, valued at $1, will be sold during the year at an excellent profit. It is estimated that our income will be increased by means of this method to the extent of at least $150,000,000 per annum which, by a coincidence, will about equal the amount of the write-down to be made each year against Contingency Reserve.

A minority report of the Special Committee recommends that Accounts Receivable and Cash also be written down to $1, in the interest of consistency and to gain additional advantages similar to those just discussed. This proposal has been rejected for the time being because our auditors still require that any recoveries of receivables and cash so charged off be credited to surplus instead of to the year's income. It is expected, however, that this auditing rule -- which is rather reminiscent of the horse-and-buggy days -- will soon be changed in line with modern tendencies. Should this occur, the minority report will be given further and favorable consideration.

5. Replacement of Preferred Stock by Non-Interest-Bearing Bonds Redeemable at 50% Discount.

During the recent depression many companies have been able to offset their operating losses by including in income profits arising from repurchases of their own bonds at a substantial discount from par. Unfortunately the credit of U. S. Steel Corporation has always stood so high that this lucrative source of revenue has not hitherto been available to it. The Modernization Scheme will remedy this condition.

It is proposed that each share of preferred stock be exchanged for $300 face value of non-interest-bearing sinking-fund notes, redeemable by lot at 50% of face value in 10 equal annual installments. This will require the issuance of $1,080,000,000 of new notes, of which $108,000,000 will be retired each year at a cost to the Corporation of only $54,000,000, thus creating an annual profit of the same amount.

Like the wage-and/or-salary plan described under 3. above, this arrangement will benefit both the Corporation and its preferred stockholders. The latter are assured payment for their present shares at 150% of par value over an average period of five years. Since short-term securities yield practically no return at present, the non-interest-bearing feature is of no real importance. The Corporation will convert its present annual charge of $25,000,000 for preferred dividends into an annual bond-retirement profit of $54,000,000 -- an aggregate yearly gain of $79,000,000.

6. Establishment of a Contingency Reserve of $1,000,000,000.

The Directors are confident that the improvements hereinbefore described will assure the Corporation of a satisfactory earning power under all conditions in the future. Under modern accounting methods, however, it is unnecessary to incur the slightest risk of loss through adverse business developments of any sort, since all these may be provided for in advance by means of a Contingency Reserve.

The Special Committee has recommended that the Corporation create such a Contingency Reserve in the fairly substantial amount of $1,000,000,000. As previously set forth, the annual write-down of inventory to $1 will be absorbed by this reserve. To prevent eventual exhaustion of the Contingency Reserve, it has been further decided that it be replenished each year by transfer of an appropriate sum from Capital Surplus. Since the latter is expected to increase each year by not less than $250,000,000 through the exercise of the Stock Option Warrants (see 3. above), it will readily make good any drains on the Contingency Reserve.

In setting up this arrangement, the Board of Directors must confess regretfully that they have been unable to improve upon the devices already employed by important corporations in transferring large sums between Capital, Capital Surplus, Contingency Reserves and other Balance Sheet Accounts. In fact, it must be admitted that our entries will be somewhat too simple, and will lack that element of extreme mystification that characterizes the most advanced procedure in this field. The Board of Directors, however, have insisted upon clarity and simplicity in framing their Modernization Plan, even at the sacrifice of possible advantage to the Corporation's earning power.

In order to show the combined effect of the new proposals upon the Corporation's earning power, we submit herewith a condensed Income Account for 1935 on two bases, viz:

In accordance with a somewhat antiquated custom there is appended herewith a condensed pro-forma Balance Sheet of the U. S. Steel Corporation as of December 31, 1935, after giving effect to proposed changes in asset and liability accounts.

*Given a Stated Value differing from Par Value, in accordance with the laws of the State of Virginia, where the company will be re-incorporated.

It is perhaps unnecessary to point out to our stockholders that modern accounting methods give rise to balance sheets differing somewhat in appearance from those of a less advanced period. In view of the very large earning power that will result from these changes in the Corporation's Balance Sheet, it is not expected that undue attention will be paid to the details of assets and liabilities.

In conclusion, the Board desires to point out that the combined procedure, whereby plant will be carried at a minus figure, our wage bill will be eliminated, and inventory will stand on our books at virtually nothing, will give U. S. Steel Corporation an enormous competitive advantage in the industry. We shall be able to sell our products at exceedingly low prices and still show a handsome margin of profit. It is the considered view of the Board of Directors that under the Modernization Scheme we shall be able to undersell all competitors to such a point that the anti-trust laws will constitute the only barrier to 100% domination of the industry.

In making this statement, the Board is not unmindful of the possibility that some of our competitors may seek to offset our new advantages by adopting similar accounting improvements. We are confident, however, that U. S. Steel will be able to retain the loyalty of its customers, old and new, through the unique prestige that will accrue to it as the originator and pioneer in these new fields of service to the user of steel. Should necessity arise, moreover, we believe we shall be able to maintain our deserved superiority by introducing still more advanced bookkeeping methods, which are even now under development in our Experimental Accounting Laboratory.

* An unpublished satire by Ben Graham, written in 1936 and given by the author to Warren Buffett in 1954 - In 1990 Letter to Berkshire Hathaway Shareholders, Appendix A.

Myron C. Taylor, Chairman of U. S. Steel Corporation, today announced the long awaited plan for completely modernizing the world's largest industrial enterprise. Contrary to expectations, no changes will be made in the company's manufacturing or selling policies. Instead, the bookkeeping system is to be entirely revamped. By adopting and further improving a number of modern accounting and financial devices the corporation's earning power will be amazingly transformed. Even under the subnormal conditions of 1935, it is estimated that the new bookkeeping methods would have yielded a reported profit of close to $50 per share on the common stock. The scheme of improvement is the result of a comprehensive survey made by Messrs. Price, Bacon, Guthrie & Colpitts; it includes the following six points:

1. Writing down of Plant Account to Minus $1,000,000,000.

2. Par value of common stock to be reduced to 1¢.

3. Payment of all wages and salaries in option warrants.

4. Inventories to be carried at $1.

5. Preferred Stock to be replaced by non-interest bearing bonds redeemable at 50% discount.

6. A $1,000,000,000 Contingency Reserve to be established.

The official statement of this extraordinary Modernization Plan follows in full:

The Board of Directors of U. S. Steel Corporation is pleased to announce that after intensive study of the problems arising from changed conditions in the industry, it has approved a comprehensive plan for remodeling the Corporation's accounting methods. A survey by a Special Committee, aided and abetted by Messrs. Price, Bacon, Guthrie & Colpitts, revealed that our company has lagged somewhat behind other American business enterprises in utilizing certain advanced bookkeeping methods, by means of which the earning power may be phenomenally enhanced without requiring any cash outlay or any changes in operating or sales conditions. It has been decided not only to adopt these newer methods, but to develop them to a still higher stage of perfection. The changes adopted by the Board may be summarized under six heads, as follows:

1. Fixed Assets to be written down to Minus $1,000,000,000.

Many representative companies have relieved their income accounts of all charges for depreciation by writing down their plant account to $1. The Special Committee points out that if their plants are worth only $1, the fixed assets of U. S. Steel Corporation are worth a good deal less than that sum. It is now a well-recognized fact that many plants are in reality a liability rather than an asset, entailing not only depreciation charges, but taxes, maintenance, and other expenditures. Accordingly, the Board has decided to extend the write-down policy initiated in the 1935 report, and to mark down the Fixed Assets from $1,338,522,858.96 to a round Minus $1,000,000,000.

The advantages of this move should be evident. As the plant wears out, the liability becomes correspondingly reduced. Hence, instead of the present depreciation charge of some $47,000,000 yearly there will be an annual appreciation credit of 5%, or $50,000,000. This will increase earnings by no less than $97,000,000 per annum.

2. Reduction of Par Value of Common Stock to 1¢, and

3. Payment of Salaries and Wages in Option Warrants.

Many corporations have been able to reduce their overhead expenses substantially by paying a large part of their executive salaries in the form of options to buy stock, which carry no charge against earnings. The full possibilities of this modern device have apparently not been adequately realized. The Board of Directors has adopted the following advanced form of this idea:

The entire personnel of the Corporation are to receive their compensation in the form of rights to buy common stock at $50 per share, at the rate of one purchase right for each $50 of salary and/or wages in their present amounts. The par value of the common stock is to be reduced to 1¢.

The almost incredible advantages of this new plan are evident from the following:

A. The payroll of the Corporation will be entirely eliminated, a saving of $250,000,000 per annum, based on 1935 operations.

B. At the same time, the effective compensation of all our employees will be increased severalfold. Because of the large earnings per share to be shown on our common stock under the new methods, it is certain that the shares will command a price in the market far above the option level of $50 per share, making the readily realizable value of these option warrants greatly in excess of the present cash wages that they will replace.

C. The Corporation will realize an additional large annual profit through the exercise of these warrants. Since the par value of the common stock will be fixed at 1¢, there will be a gain of $49.99 on each share subscribed for. In the interest of conservative accounting, however, this profit will not be included in the income account, but will be shown separately as a credit to Capital Surplus.

D. The Corporation's cash position will be enormously strengthened. In place of the present annual cash outgo of $250,000,000 for wages (1935 basis), there will be annual cash inflow of $250,000,000 through exercise of the subscription warrants for 5,000,000 shares of common stock. The Company's large earnings and strong cash position will permit the payment of a liberal dividend which, in turn, will result in the exercise of these option warrants immediately after issuance which, in turn, will further improve the cash position which, in turn, will permit a higher dividend rate -- and so on, indefinitely.

4. Inventories to be carried at $1.

Serious losses have been taken during the depression due to the necessity of adjusting inventory value to market. Various enterprises -- notably in the metal and cotton-textile fields -- have successfully dealt with this problem by carrying all or part of their inventories at extremely low unit prices. The U. S. Steel Corporation has decided to adopt a still more progressive policy, and to carry its entire inventory at $1. This will be effected by an appropriate write-down at the end of each year, the amount of said write-down to be charged to the Contingency Reserve hereinafter referred to.

The benefits to be derived from this new method are very great. Not only will it obviate all possibility of inventory depreciation, but it will substantially enhance the annual earnings of the Corporation. The inventory on hand at the beginning of the year, valued at $1, will be sold during the year at an excellent profit. It is estimated that our income will be increased by means of this method to the extent of at least $150,000,000 per annum which, by a coincidence, will about equal the amount of the write-down to be made each year against Contingency Reserve.

A minority report of the Special Committee recommends that Accounts Receivable and Cash also be written down to $1, in the interest of consistency and to gain additional advantages similar to those just discussed. This proposal has been rejected for the time being because our auditors still require that any recoveries of receivables and cash so charged off be credited to surplus instead of to the year's income. It is expected, however, that this auditing rule -- which is rather reminiscent of the horse-and-buggy days -- will soon be changed in line with modern tendencies. Should this occur, the minority report will be given further and favorable consideration.

5. Replacement of Preferred Stock by Non-Interest-Bearing Bonds Redeemable at 50% Discount.

During the recent depression many companies have been able to offset their operating losses by including in income profits arising from repurchases of their own bonds at a substantial discount from par. Unfortunately the credit of U. S. Steel Corporation has always stood so high that this lucrative source of revenue has not hitherto been available to it. The Modernization Scheme will remedy this condition.

It is proposed that each share of preferred stock be exchanged for $300 face value of non-interest-bearing sinking-fund notes, redeemable by lot at 50% of face value in 10 equal annual installments. This will require the issuance of $1,080,000,000 of new notes, of which $108,000,000 will be retired each year at a cost to the Corporation of only $54,000,000, thus creating an annual profit of the same amount.

Like the wage-and/or-salary plan described under 3. above, this arrangement will benefit both the Corporation and its preferred stockholders. The latter are assured payment for their present shares at 150% of par value over an average period of five years. Since short-term securities yield practically no return at present, the non-interest-bearing feature is of no real importance. The Corporation will convert its present annual charge of $25,000,000 for preferred dividends into an annual bond-retirement profit of $54,000,000 -- an aggregate yearly gain of $79,000,000.

6. Establishment of a Contingency Reserve of $1,000,000,000.

The Directors are confident that the improvements hereinbefore described will assure the Corporation of a satisfactory earning power under all conditions in the future. Under modern accounting methods, however, it is unnecessary to incur the slightest risk of loss through adverse business developments of any sort, since all these may be provided for in advance by means of a Contingency Reserve.

The Special Committee has recommended that the Corporation create such a Contingency Reserve in the fairly substantial amount of $1,000,000,000. As previously set forth, the annual write-down of inventory to $1 will be absorbed by this reserve. To prevent eventual exhaustion of the Contingency Reserve, it has been further decided that it be replenished each year by transfer of an appropriate sum from Capital Surplus. Since the latter is expected to increase each year by not less than $250,000,000 through the exercise of the Stock Option Warrants (see 3. above), it will readily make good any drains on the Contingency Reserve.

In setting up this arrangement, the Board of Directors must confess regretfully that they have been unable to improve upon the devices already employed by important corporations in transferring large sums between Capital, Capital Surplus, Contingency Reserves and other Balance Sheet Accounts. In fact, it must be admitted that our entries will be somewhat too simple, and will lack that element of extreme mystification that characterizes the most advanced procedure in this field. The Board of Directors, however, have insisted upon clarity and simplicity in framing their Modernization Plan, even at the sacrifice of possible advantage to the Corporation's earning power.

In order to show the combined effect of the new proposals upon the Corporation's earning power, we submit herewith a condensed Income Account for 1935 on two bases, viz:

In accordance with a somewhat antiquated custom there is appended herewith a condensed pro-forma Balance Sheet of the U. S. Steel Corporation as of December 31, 1935, after giving effect to proposed changes in asset and liability accounts.

*Given a Stated Value differing from Par Value, in accordance with the laws of the State of Virginia, where the company will be re-incorporated.

It is perhaps unnecessary to point out to our stockholders that modern accounting methods give rise to balance sheets differing somewhat in appearance from those of a less advanced period. In view of the very large earning power that will result from these changes in the Corporation's Balance Sheet, it is not expected that undue attention will be paid to the details of assets and liabilities.

In conclusion, the Board desires to point out that the combined procedure, whereby plant will be carried at a minus figure, our wage bill will be eliminated, and inventory will stand on our books at virtually nothing, will give U. S. Steel Corporation an enormous competitive advantage in the industry. We shall be able to sell our products at exceedingly low prices and still show a handsome margin of profit. It is the considered view of the Board of Directors that under the Modernization Scheme we shall be able to undersell all competitors to such a point that the anti-trust laws will constitute the only barrier to 100% domination of the industry.

In making this statement, the Board is not unmindful of the possibility that some of our competitors may seek to offset our new advantages by adopting similar accounting improvements. We are confident, however, that U. S. Steel will be able to retain the loyalty of its customers, old and new, through the unique prestige that will accrue to it as the originator and pioneer in these new fields of service to the user of steel. Should necessity arise, moreover, we believe we shall be able to maintain our deserved superiority by introducing still more advanced bookkeeping methods, which are even now under development in our Experimental Accounting Laboratory.

quarta-feira, setembro 12, 2007

Applying Behavioral Finance to Value Investing

Excelente documento onde Whitney Tilson da Tilson Funds examina as diferentes variáveis determinantes do comportamento do indivíduo e que mais influenciam na tomada de más decisões em termos financeiros (Behavioral Finance) e principalmente quando se olha de um ponto de vista de investimento em valor (Value Investing).

Podem consultar o documento aqui.

Podem consultar o documento aqui.

sexta-feira, agosto 24, 2007

quarta-feira, agosto 22, 2007

Riding Out the Storm with Quality Stocks

Like Warren Buffett, Larry Coats of Oak Value Fund sticks with companies that are understood and valued. Top holding: Berkshire Hathaway

Ver todo o artigo aqui.

Ver todo o artigo aqui.

quarta-feira, agosto 08, 2007

Bruce Berkowitz em entrevista ao WealthTrack

Bruce Berkowitz, fundador e gestor do Fairholme Fund, falau no programa Consuelo Mack WealthTrack em 3 Agosto 2007. Berkowitz discutiu como com algumas acções e muito cash disponível permitiram o seu fundo bater o mercado e ganhar dinheiro em todas as condições do mesmo.

*Também podem ler o Fairholme Fund 2007 Semi-Annual Report ou ver a CNBC Interview with Burce Berkowitz em Junho.

*Também podem ler o Fairholme Fund 2007 Semi-Annual Report ou ver a CNBC Interview with Burce Berkowitz em Junho.

quarta-feira, julho 04, 2007

Mohnish Pabrai: Resumo do Livro Dhandho Investor

Bjorn Kijl elaborou um interessante resumo do mais recente livro de Mohnish Pabrai - The Dhandho Investor, o value investor que tem merecido bastante exposição, pelo livro que apresentou, pelos resultados que tem divulgado e também por ter sido o vencedor do leilão anual para um almoço com o Warren Buffet (para caridade) tendo de desembolsar mais de 650.000$.

A estratégia de Pabrai cola-se bastante aos métodos de investimento do Warren Buffett, mas apresenta alguns conceitos interessantes como:

- O investimento em activos de baixo risco e alta incerteza, que se pode traduzir por activos que se encontrem em avaliações substancialmente abaixo do seu valor intrínseco e em que haja no mercado uma incerteza muito grande em relação às suas perspectivas futuras;

- Outra ideia interessante, que vem descrita num artigo da guru focus, é a de placeholder, ou seja, pabrai não acredita que colocar dinheiro no banco seja um bom investimento devido à depreciação do dinheiro pelo que será sempre preferível procurar um activo o mais seguro possível e que proporcione um retorno adequado. Para ele esse activo, actualmente, são as acções da Berkshire Hathaway.

A estratégia de Pabrai cola-se bastante aos métodos de investimento do Warren Buffett, mas apresenta alguns conceitos interessantes como:

- O investimento em activos de baixo risco e alta incerteza, que se pode traduzir por activos que se encontrem em avaliações substancialmente abaixo do seu valor intrínseco e em que haja no mercado uma incerteza muito grande em relação às suas perspectivas futuras;

- Outra ideia interessante, que vem descrita num artigo da guru focus, é a de placeholder, ou seja, pabrai não acredita que colocar dinheiro no banco seja um bom investimento devido à depreciação do dinheiro pelo que será sempre preferível procurar um activo o mais seguro possível e que proporcione um retorno adequado. Para ele esse activo, actualmente, são as acções da Berkshire Hathaway.

terça-feira, julho 03, 2007

Peter Lynch's One up on Wall Street - notes - 1st half

June-30-2007

Peter Lynch's One up on Wall Street - notes - 1st halfby Tahmeed Ahmad

Review of Peter Lynch's first book: One up on Wall Street. Part I.

One point he does emphasis, however, is that most people should purchase a house before they invest in stocks since they tend to do more research. He also mentions that you have an edge in the industry you work at that you can exploit since you have access to information before the Wall Street analysts. He makes it a point to exploit edges, and I agree:

Lynch - 1st half "What makes a company valuable, and why it will be more valuable tomorrow than it is today... earnings and assets"

Earnings drive the stock price.

Compare P/E across companies within the same industry.

Track P/E ratio back across several years for a company.

High P/E of overall market during end of bull markets.

Low interest rates drives a stock's P/E up.

Predicting future earnings is tough, just get a rough estimate. More importantly, find out HOW a company plans to increase its earnings. Then you can check periodically if plans are working out.

Five ways a company can increase earnings:

1) Reduce costs

2) Raise prices - You can raise the price with an exclusive franchise.

3) Expand into new markets

4) Sell more of its product in old markets

5) Revitalize, close or otherwise dispose of a losing operation.

STOCKS TO AVOID

Avoid the hottest stock in the hottest industry - the one that gets the more favorable publicity.

Beware of the "next something" speculators. Avoid stocks that are being touted as the next IBM or next McDonalds or next Disney. ~

Avoid "diworseifications" - "Instead of buying back shares or raising dividends, profitable companies often prefer to blow the money on foolish acquisitions. The dedicated oiworseifier seeking out merchandise that is (1) overpriced and (2) complete beyond his or her realm of understanding. This ensures that losses will be maximized."

Beware of the whisper stock - the long shot stock that people tell you is a hot, but secret tip. something they are only telling you.

Beware of the middle man - "The company that sells 20 to 25 percent of its wares to a single customer is in a precarious situation.... short of cancellation, the big customer has incredible leverage in extracting price cuts and other concessions that will reduce the supplier's profits. it's rare that a great investment could result from such an arrangement."

Beware the stock with the exciting name - people will fall in love with it.

The Perfect Stock

Getting the story is easier if you understand the basic business. The simpler it is, the better. "An idiot could run this joint," because sooner or later any idiot probably is going to be running it.

"If it's a choice between owning stock in a fine company with excellent management in a highly competitive and complex industry, or a humdrum company with mediocre management in a simpleminded industry with no competition, I'd take the latter. For one thing, it's easier to follow."

"Any idiot can run this business" is one characteristic of the perfect company.

1) It sounds dull, or even better, ridiculous. The perfect stock ought to have a perfectly boring name.

2) It does something dull It does something boring, like make cans and bottle caps.

3) It does something disagreeable A stock that makes people shrug, retch or turn away in disgust is ideal.

4) It's a spin off

5) The institutions don't own it, and the analysts don't follow it "If you find a stock with little or no institutional ownerships, you've found a potential winner. Find a company that no analyst has ever visited, or that no analyst would admit to knowing about, and you've got a double winner... It frequently happens with banks, savings and loans, and insurance companies since there are thousands of these."

6) The rumors abound: It's involved with toxic waste and/or the mafia

7) There's something depressing about it

8) It's a no-growth indsutry no growth, like plastic knives, and forks. "For every single product in a hot industry, there are a thousand MIT graduates trying to figure out how to make it cheaper in Taiwan... This doesn't happen with bottle caps, coupon-clipping services, oil-drum retrieval, or motel chains."

9) It's got a niche Niche means there is little or no competition. People can buy jewelery from anywhere - internet, out of state, across the street. An asset play, no one can compete with. Exclusive franchises are a niche, they have value. You can raise the price with an exclusive franchise. Newspapers used to be niches. Drug companies and companies with patents have niches, since no one else can make their drug. Chemical companies have niches because getting a poison approved is as hard as a drug. Brand names are niches, like Robitussin, Coca-Cola, Tylenol, Marlboro.

10) People have to keep buying it - self explanatory

11) It's a user of technology - as technology is advanced and becomes cheaper, costs are reduces.

12) The insiders are buyers "In general, corporate insiders are net sellers, and they normally sell 2.3 shares to every one share that they buy... When insiders are buying like crazy, you can be certain that, at a minimum, the company will not go bankrupt in the next six months... Long term... when management owns stock, then rewarding shareholders becomes a first priority... it's more significant when employees at lower echelons add to their positions. if you see someone with a $45,000 annual salary buying $10,000 worth of stock, you can be sure it's a meaningful vote of confidence"

13) The company is buying back shares - you guys know this one already.

in http://www.gurufocus.com/news.php?id=8366

Peter Lynch's One up on Wall Street - notes - 1st halfby Tahmeed Ahmad

Review of Peter Lynch's first book: One up on Wall Street. Part I.

One point he does emphasis, however, is that most people should purchase a house before they invest in stocks since they tend to do more research. He also mentions that you have an edge in the industry you work at that you can exploit since you have access to information before the Wall Street analysts. He makes it a point to exploit edges, and I agree:

Lynch - 1st half "What makes a company valuable, and why it will be more valuable tomorrow than it is today... earnings and assets"

Earnings drive the stock price.

Compare P/E across companies within the same industry.

Track P/E ratio back across several years for a company.

High P/E of overall market during end of bull markets.

Low interest rates drives a stock's P/E up.

Predicting future earnings is tough, just get a rough estimate. More importantly, find out HOW a company plans to increase its earnings. Then you can check periodically if plans are working out.

Five ways a company can increase earnings:

1) Reduce costs

2) Raise prices - You can raise the price with an exclusive franchise.

3) Expand into new markets

4) Sell more of its product in old markets

5) Revitalize, close or otherwise dispose of a losing operation.

STOCKS TO AVOID

Avoid the hottest stock in the hottest industry - the one that gets the more favorable publicity.

Beware of the "next something" speculators. Avoid stocks that are being touted as the next IBM or next McDonalds or next Disney. ~

Avoid "diworseifications" - "Instead of buying back shares or raising dividends, profitable companies often prefer to blow the money on foolish acquisitions. The dedicated oiworseifier seeking out merchandise that is (1) overpriced and (2) complete beyond his or her realm of understanding. This ensures that losses will be maximized."

Beware of the whisper stock - the long shot stock that people tell you is a hot, but secret tip. something they are only telling you.

Beware of the middle man - "The company that sells 20 to 25 percent of its wares to a single customer is in a precarious situation.... short of cancellation, the big customer has incredible leverage in extracting price cuts and other concessions that will reduce the supplier's profits. it's rare that a great investment could result from such an arrangement."

Beware the stock with the exciting name - people will fall in love with it.

The Perfect Stock

Getting the story is easier if you understand the basic business. The simpler it is, the better. "An idiot could run this joint," because sooner or later any idiot probably is going to be running it.

"If it's a choice between owning stock in a fine company with excellent management in a highly competitive and complex industry, or a humdrum company with mediocre management in a simpleminded industry with no competition, I'd take the latter. For one thing, it's easier to follow."

"Any idiot can run this business" is one characteristic of the perfect company.

1) It sounds dull, or even better, ridiculous. The perfect stock ought to have a perfectly boring name.

2) It does something dull It does something boring, like make cans and bottle caps.

3) It does something disagreeable A stock that makes people shrug, retch or turn away in disgust is ideal.

4) It's a spin off

5) The institutions don't own it, and the analysts don't follow it "If you find a stock with little or no institutional ownerships, you've found a potential winner. Find a company that no analyst has ever visited, or that no analyst would admit to knowing about, and you've got a double winner... It frequently happens with banks, savings and loans, and insurance companies since there are thousands of these."

6) The rumors abound: It's involved with toxic waste and/or the mafia

7) There's something depressing about it

8) It's a no-growth indsutry no growth, like plastic knives, and forks. "For every single product in a hot industry, there are a thousand MIT graduates trying to figure out how to make it cheaper in Taiwan... This doesn't happen with bottle caps, coupon-clipping services, oil-drum retrieval, or motel chains."

9) It's got a niche Niche means there is little or no competition. People can buy jewelery from anywhere - internet, out of state, across the street. An asset play, no one can compete with. Exclusive franchises are a niche, they have value. You can raise the price with an exclusive franchise. Newspapers used to be niches. Drug companies and companies with patents have niches, since no one else can make their drug. Chemical companies have niches because getting a poison approved is as hard as a drug. Brand names are niches, like Robitussin, Coca-Cola, Tylenol, Marlboro.

10) People have to keep buying it - self explanatory

11) It's a user of technology - as technology is advanced and becomes cheaper, costs are reduces.

12) The insiders are buyers "In general, corporate insiders are net sellers, and they normally sell 2.3 shares to every one share that they buy... When insiders are buying like crazy, you can be certain that, at a minimum, the company will not go bankrupt in the next six months... Long term... when management owns stock, then rewarding shareholders becomes a first priority... it's more significant when employees at lower echelons add to their positions. if you see someone with a $45,000 annual salary buying $10,000 worth of stock, you can be sure it's a meaningful vote of confidence"

13) The company is buying back shares - you guys know this one already.

in http://www.gurufocus.com/news.php?id=8366

sexta-feira, junho 22, 2007

Entrevista a Mohnish Pabrai, Bloomberg 19 Junho

Mohnish Pabrai, humilde discípulo de Warren Buffett, discute algumas das questões mais relevantes do value investing como a maior relevância dos factores microeconómicos em relação aos macroeconómicos, bem como a postura de empreendedor que se deve ter na gestão de um portfólio.

Bloomberg Clip Parte 1

Bloomberg Clip Parte 2

Bloomberg Clip Parte 1

Bloomberg Clip Parte 2

quinta-feira, junho 21, 2007

Entrevista aos Gestores do Oak Value Fund

David Carr e Larry Coats, são os gestores do Oak Value Capital Management em Durham, N.C, exemplo do investimento em valor. Têm batido o mercado desde 1986 com uma rentabilidade média anualizada de 14.7% contra 11.8%/ano do S&P.

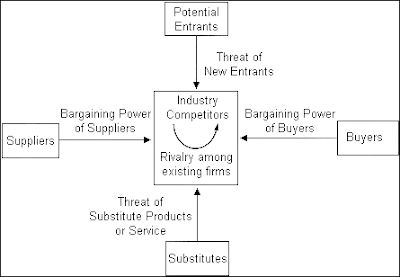

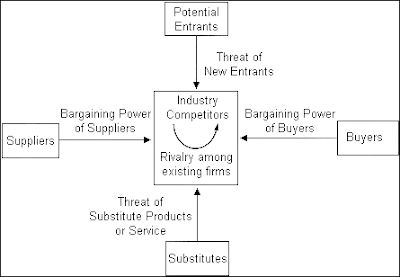

Interessante a associação que fazem do "moat" de um negócio, definição dada pelo Warren Buffett a uma empresa que possui nítidas vantagens competitivas no seu mercado impedindo o acesso de potenciais concorrentes, e as "5 forças" que Michael Porter utiliza para avaliar o posicionamento da empresa relativamente aos seus clientes, fornecedores, competidores actuais, potenciais competidores e produtos substitutos. Os dois conceitos são bastante semelhantes e permitem determinar a previsibilidade dos resultados do negócio.

Parte 1 Parte 2 Parte 3 Parte 4 Parte 5 Parte 6

in Motley Fool http://www.fool.com/

Interessante a associação que fazem do "moat" de um negócio, definição dada pelo Warren Buffett a uma empresa que possui nítidas vantagens competitivas no seu mercado impedindo o acesso de potenciais concorrentes, e as "5 forças" que Michael Porter utiliza para avaliar o posicionamento da empresa relativamente aos seus clientes, fornecedores, competidores actuais, potenciais competidores e produtos substitutos. Os dois conceitos são bastante semelhantes e permitem determinar a previsibilidade dos resultados do negócio.

Parte 1 Parte 2 Parte 3 Parte 4 Parte 5 Parte 6

in Motley Fool http://www.fool.com/

segunda-feira, junho 18, 2007

Bestiver - Gestión de Patrimonios

" Buscamos valor em cada invérsion que realizamos"

"Price is what you pay value is what you get", Warren Buffett

Esta é a primeira imagem do site da Bestiver, uma gestora de patrimónios espanhola detida pela Acciona e liderada por Francisco García Paramés que recentemente surgiu nas notícias do mundo financeiro por ter recebido resposta do Warren Buffett a uma carta sua sugerindo-lhe uma ideia de negócio, pedindo ideias de investimento em empresas privadas à dimensão da Berkshire em Espanha. O gestor que não vislumbra oportunidades no mercado espanhol actualmente, continua a encontrar valor em Portugal, conforme noticiou o Jornal de Negócios.

Ao investigar um pouco mais a história desta Gestora de Patromónios e do seu gestor descobri, efectivamente, mais um exemplo extraordinário de um grande investidor em valor digno dos Superinvestors of Graham and Doddsville. Efectivamente, Paramés é fã confesso de Buffett, da sua filosofia de investimento, da sua interpretação do mercado de acções. Tal transparece nas várias entrevistas disponíveis no seu site, nomeadamente esta.

E o track record é espectacular. O melhor de Espanha, um dos melhores do mundo. Desde 1999, e passando por todo o Bear Market, conseguiu um retorno de 27%/ano. Ficam as taxas de retorno desde o ínicio.

"Price is what you pay value is what you get", Warren Buffett

Esta é a primeira imagem do site da Bestiver, uma gestora de patrimónios espanhola detida pela Acciona e liderada por Francisco García Paramés que recentemente surgiu nas notícias do mundo financeiro por ter recebido resposta do Warren Buffett a uma carta sua sugerindo-lhe uma ideia de negócio, pedindo ideias de investimento em empresas privadas à dimensão da Berkshire em Espanha. O gestor que não vislumbra oportunidades no mercado espanhol actualmente, continua a encontrar valor em Portugal, conforme noticiou o Jornal de Negócios.

Ao investigar um pouco mais a história desta Gestora de Patromónios e do seu gestor descobri, efectivamente, mais um exemplo extraordinário de um grande investidor em valor digno dos Superinvestors of Graham and Doddsville. Efectivamente, Paramés é fã confesso de Buffett, da sua filosofia de investimento, da sua interpretação do mercado de acções. Tal transparece nas várias entrevistas disponíveis no seu site, nomeadamente esta.

E o track record é espectacular. O melhor de Espanha, um dos melhores do mundo. Desde 1999, e passando por todo o Bear Market, conseguiu um retorno de 27%/ano. Ficam as taxas de retorno desde o ínicio.

Entrevista a Bruce Berkowitz

Curta entrevista da CNBC com Bruce Berkowitz, gestor do fundo Fairholme. Um dos melhores representantes do investimento em valor fala acerca dos seus investimentos nos mercados do petróleo e gás, das qualidades que procura nas administrações que investiga e das suas posições actuais - Canadian Natural Resources (CNQ) e Berkshire Hathaway (BRK.A).

Vídeo

Vídeo

Entrevista a Mohnish Pabrai

Curta entrevista da CNBC com CNBC com Mohnish Pabrai, sócio gerente da Pabrai Funds, a 31 Maio 2007. Mohnish Pabrai fala da sua estratégia de investimento em valor, apostas pequenas, apostas maiores, apostas invulgares e estratégia "copy cats". É o autor de The Dhandho Investor e de Mosaic: Perspectives on Investing.

Vídeo

Vídeo

segunda-feira, junho 11, 2007

Little Book of Value Investing

O autor é um dos administradores da Tweedy, Browne Company LLC, Christopher Brown, herdeiro de uma filisofia de investimento em valor que vinha do seu pai e dos relacionamentos deste com Benjamin Graham e Warren Buffett, como seu corrector, que lhe permitiram absorver as ideias do value investing. Com provas dadas no mercado a Tweedy, Brown Company é um dos Superinvestors of Graham-Doddsville enumerados por Warren Buffet.

O livro sintetiza algumas das regras do investimento em valor focando temas como a avaliação e a paciência do investidor. Desenvolve bastante também a importância de se considerar todo o mercado mundial na procura de oportunidades de investimento.

Filosofia de Investimento da Tweedy, Brown Company

O livro sintetiza algumas das regras do investimento em valor focando temas como a avaliação e a paciência do investidor. Desenvolve bastante também a importância de se considerar todo o mercado mundial na procura de oportunidades de investimento.

Filosofia de Investimento da Tweedy, Brown Company

terça-feira, junho 05, 2007

Value Investing com Joel Greenblatt

Conferência de Joel Greenblatt na 2006 Columbia Reunion sobre o seu livro The Little Book That Beats the Market e o método de investimento da sua gestora de patrimónios, a Gotham Capital's.

http://merlin.gsb.columbia.edu:8080/ramgen/video3/admin/alumni/Reunion_2006/Reunion_4-8-06_Greenblatt.rm

http://merlin.gsb.columbia.edu:8080/ramgen/video3/admin/alumni/Reunion_2006/Reunion_4-8-06_Greenblatt.rm

terça-feira, maio 22, 2007

sexta-feira, maio 18, 2007

You Can Be a Stock Market Genius by Joel Greenblatt

Excelente livro do Joel Greenblatt que no ensina como podemos aproveitar boas valorizações em situações menos acompanhadas pelo mercado em geral. Spinoffs, reestruturações, falências, opções de longo prazo, etc.

Fica um pequeno resumo que fiz do livro.

1. Spinoffs

a)Os Institucionais não querem (e as suas razões não têm nada a ver com os méritos do investimento): não vão entrar nos índices, têm dívidas muito elevadas, negócio muito diferente da casa mãe, casos em tribunal.

b)Os Insiders querem: insiders ficam com posições relevantes no spinoff e com posições de destaque na administração da empresa.

c)Uma anterior oportunidade escondida é revelada: o spinoff revela um negócio excelente anteriormente escondido, ou activos relevantes subavaliados.

d)A empresa mãe, com o spinoff, também pode libertar algum valor ao concentrar-se no seu core business.

e)Procurar artigos sobre spinoffs na imprensa e nos documentos da SEC.

2. Spinoffs Parciais

a)Um spinoff parcial permite aos investidores avaliarem directamente uma unidade de negócio da empresa mãe e indirectamente o valor da própria empresa mãe.

b)Por vezes o spinoff pode ser feito com a atribuição de direitos de subscrição, tendo a empresa o intuito de angariar capital. Boas oportunidades de subscrição ou de arbitragem de direitos podem surgir.

3. Arbitragem em operações de Fusões e Aquisições

a)Em operações a dinheiro compra-se a acção adquirida a desconto e espera-se pela conclusão do processo de aquisição.

b)Nas operações com troca de acções compra-se a acção adquirida a desconto e vende-se curto a acção adquirente, eliminando assim o risco de desvalorização da acção adquirente.

c)Riscos: A operação pode ser interrompida ou pode tomar mais tempo do que o previsto.

d)Nota: As oportunidades são cada vez menores nesta área.

e)Operações com outros instrumentos que não acções (obrigações, acções preferenciais, warrants e direitos). Normalmente quer institucionais quer particulares vendem estes activos o que pode representar uma boa oportunidade de compra.

4. Falências

a)A melhor altura para entrar em empresas que passaram por processos de falência é quando saem desses processos.

b)A empresa reestrutura o balanço. Muitos credores passam a ser accionistas de um negócio que não querem e vendem. Vale a pena analisar os novos activos financeiros emitidos.

c)A empresa faz projecções operacionais que serão úteis para avaliar o potencial do negócio pós-processo de falência.

d)Empresas inseridas nestes processos mas com vantagens competitivas (marca, rede, escala) terão maior probabilidade de sucesso.

e)Devemos aguentar as boas acções e fazer trade com os negócios mais fracos.

5. Reestruturações

a)Podem libertar muito valor. Olhar para as situações com o downside limitado: empresas a transaccionar perto do valor contabilístico, com pouca dívida e uma grande parte dos activos correntes.

b)Procurar administrações motivadas.

c)Vendas de unidades, spinoffs ou grandes planos de recompra de acções podem ser catalizadores

d)Duas formas de aproveitar: antes ou depois do anúncio da reestruturação.

6. Recapitalizações, LEAPS, Warrants e Opções

a)Em grandes recapitalizações (Troca de capital próprio por dívida) é possível obter bons retornos na medida em que normalmente as acções corrigem mais do que deviam, mesmo tendo em conta avaliações mais conservadores de resultados e PER’s devido aos níveis de dívida superiores. A alavancagem do balanço permite também maiores retornos com o mesmo capital próprio investido.

b)LEAPS: opções de prazos mais longos. Permitem alacancar a exposição a uma determinada acção. Ideal para situações de clara subavaliação de curto prazo, que pode ser corrigida no prazo de 2 ou 3 anos.

c)Warrants e Opções: permitem alavancar posições. Em situações de spinoffs podem ficar extremamente subavaliadas.

De onde tirar ideias

Jornais: Wall Street Journal, New York Times, Barron’s, Investor’s Daily Digital.

Revistas: Forbes, Smart Money, Business Week, Fortune.

Newsletters: Outstanding Investor’s Digest, The Turnaround Letter, Dick Davis Digest.

Fundos: Franklin Mutual Series Funds (Michael Price), Third Avenue Value Fund (Mary Whitman), Pzena Focused Value Fund (Richard Pzena).

Informação empresa e das operações:

SEC Filings 10k’s e 10Q’s

Form 8K: Aquisições, venda activos, falência, mudança de controlo.

Form: S1, S2, S3 e S4: Registo de novos instrumentos financeiros.

Form 10: Informação sobre spinioff.

Form 13D: Report de participações superiores a 5%.

Form 13G: Report de participações para investidores estrangeiros.

Schedule 14D-1: Formulário de oferta pública de aquisição.

Schedule 13E-3 e 13E-4: Retirada da empresa de bolsa.

Todos estes formulários estão disponíveis em www.sec.gov ou www.edgar-online.com.

Mais info sobre Joel Greenblatt em http://en.wikipedia.org/wiki/Joel_Greenblatt.

Podem ver o livro em http://www.amazon.com/You-Can-Stock-Market-Genius/dp/0684840073

Fica um pequeno resumo que fiz do livro.

1. Spinoffs

a)Os Institucionais não querem (e as suas razões não têm nada a ver com os méritos do investimento): não vão entrar nos índices, têm dívidas muito elevadas, negócio muito diferente da casa mãe, casos em tribunal.

b)Os Insiders querem: insiders ficam com posições relevantes no spinoff e com posições de destaque na administração da empresa.

c)Uma anterior oportunidade escondida é revelada: o spinoff revela um negócio excelente anteriormente escondido, ou activos relevantes subavaliados.

d)A empresa mãe, com o spinoff, também pode libertar algum valor ao concentrar-se no seu core business.

e)Procurar artigos sobre spinoffs na imprensa e nos documentos da SEC.

2. Spinoffs Parciais

a)Um spinoff parcial permite aos investidores avaliarem directamente uma unidade de negócio da empresa mãe e indirectamente o valor da própria empresa mãe.

b)Por vezes o spinoff pode ser feito com a atribuição de direitos de subscrição, tendo a empresa o intuito de angariar capital. Boas oportunidades de subscrição ou de arbitragem de direitos podem surgir.

3. Arbitragem em operações de Fusões e Aquisições

a)Em operações a dinheiro compra-se a acção adquirida a desconto e espera-se pela conclusão do processo de aquisição.

b)Nas operações com troca de acções compra-se a acção adquirida a desconto e vende-se curto a acção adquirente, eliminando assim o risco de desvalorização da acção adquirente.

c)Riscos: A operação pode ser interrompida ou pode tomar mais tempo do que o previsto.

d)Nota: As oportunidades são cada vez menores nesta área.

e)Operações com outros instrumentos que não acções (obrigações, acções preferenciais, warrants e direitos). Normalmente quer institucionais quer particulares vendem estes activos o que pode representar uma boa oportunidade de compra.

4. Falências

a)A melhor altura para entrar em empresas que passaram por processos de falência é quando saem desses processos.

b)A empresa reestrutura o balanço. Muitos credores passam a ser accionistas de um negócio que não querem e vendem. Vale a pena analisar os novos activos financeiros emitidos.

c)A empresa faz projecções operacionais que serão úteis para avaliar o potencial do negócio pós-processo de falência.

d)Empresas inseridas nestes processos mas com vantagens competitivas (marca, rede, escala) terão maior probabilidade de sucesso.

e)Devemos aguentar as boas acções e fazer trade com os negócios mais fracos.

5. Reestruturações

a)Podem libertar muito valor. Olhar para as situações com o downside limitado: empresas a transaccionar perto do valor contabilístico, com pouca dívida e uma grande parte dos activos correntes.

b)Procurar administrações motivadas.

c)Vendas de unidades, spinoffs ou grandes planos de recompra de acções podem ser catalizadores

d)Duas formas de aproveitar: antes ou depois do anúncio da reestruturação.

6. Recapitalizações, LEAPS, Warrants e Opções

a)Em grandes recapitalizações (Troca de capital próprio por dívida) é possível obter bons retornos na medida em que normalmente as acções corrigem mais do que deviam, mesmo tendo em conta avaliações mais conservadores de resultados e PER’s devido aos níveis de dívida superiores. A alavancagem do balanço permite também maiores retornos com o mesmo capital próprio investido.

b)LEAPS: opções de prazos mais longos. Permitem alacancar a exposição a uma determinada acção. Ideal para situações de clara subavaliação de curto prazo, que pode ser corrigida no prazo de 2 ou 3 anos.

c)Warrants e Opções: permitem alavancar posições. Em situações de spinoffs podem ficar extremamente subavaliadas.

De onde tirar ideias

Jornais: Wall Street Journal, New York Times, Barron’s, Investor’s Daily Digital.

Revistas: Forbes, Smart Money, Business Week, Fortune.

Newsletters: Outstanding Investor’s Digest, The Turnaround Letter, Dick Davis Digest.

Fundos: Franklin Mutual Series Funds (Michael Price), Third Avenue Value Fund (Mary Whitman), Pzena Focused Value Fund (Richard Pzena).

Informação empresa e das operações:

SEC Filings 10k’s e 10Q’s

Form 8K: Aquisições, venda activos, falência, mudança de controlo.

Form: S1, S2, S3 e S4: Registo de novos instrumentos financeiros.

Form 10: Informação sobre spinioff.

Form 13D: Report de participações superiores a 5%.

Form 13G: Report de participações para investidores estrangeiros.

Schedule 14D-1: Formulário de oferta pública de aquisição.

Schedule 13E-3 e 13E-4: Retirada da empresa de bolsa.

Todos estes formulários estão disponíveis em www.sec.gov ou www.edgar-online.com.

Mais info sobre Joel Greenblatt em http://en.wikipedia.org/wiki/Joel_Greenblatt.

Podem ver o livro em http://www.amazon.com/You-Can-Stock-Market-Genius/dp/0684840073

terça-feira, maio 15, 2007

quarta-feira, maio 09, 2007

segunda-feira, maio 07, 2007

Entrevista com Bill Miller

Entrevista de 25 minutos com um dos mais bem sucedidos gestores de fundos dos últimos anos: Bill Miller.

http://www.leggmason.com/about/wt_video.asp

http://www.leggmason.com/about/wt_video.asp

sexta-feira, maio 04, 2007

quinta-feira, maio 03, 2007

Inside Buffett's Investing Strategy

Inside Buffett's Investing Strategy

Some of the key tenets of the Oracle of Omaha's philosophy.

By Paul A. Larson 05-02-07 06:00 AM

"In our view … investment students need only two well-taught courses--How to Value a Business, and How to Think About Market Prices." Warren Buffett, whose Berkshire Hathaway (BRK.B) holding company is convening its annual shareholders meeting May 5, is widely regarded as the world's most successful investor, and it is no mistake we at Morningstar have repeatedly echoed his wisdom. The book value of Berkshire compounded at 21.4% per year between 1965 and 2006. That is more than double the 10.4% pretax return to the S&P 500 over the same period. According to Forbes, Buffett is the world's second-richest man with a net worth of about $52 billion as of March 2007. But he didn't stumble across a giant oil field, develop software, or inherit wealth. Rather, he built his fortune solely through astute investing. Aspiring investors, then, will certainly benefit by studying his methods. Fortunately, Buffett has been forthcoming in Berkshire's annual reports and shareholders meetings. (Click here to watch our Berkshire Hathaway Annual Meeting Preview video. And for on-the-spot coverage of this year's meeting, be sure to visit Morningstar.com on May 5 to read our analyst blog on the event.)

In Berkshire's 1977 annual report, Buffett described the central principles of his investment strategy:

"We select our marketable equity securities in much the way we would evaluate a business for acquisition in its entirety. We want the business to be one (a) that we can understand; (b) with favorable long-term prospects; (c) operated by honest and competent people; and (d) available at a very attractive price."

in Morningstar http://news.morningstar.com/article/article.asp?id=191671&pgid=wwhome1a

Some of the key tenets of the Oracle of Omaha's philosophy.

By Paul A. Larson 05-02-07 06:00 AM

"In our view … investment students need only two well-taught courses--How to Value a Business, and How to Think About Market Prices." Warren Buffett, whose Berkshire Hathaway (BRK.B) holding company is convening its annual shareholders meeting May 5, is widely regarded as the world's most successful investor, and it is no mistake we at Morningstar have repeatedly echoed his wisdom. The book value of Berkshire compounded at 21.4% per year between 1965 and 2006. That is more than double the 10.4% pretax return to the S&P 500 over the same period. According to Forbes, Buffett is the world's second-richest man with a net worth of about $52 billion as of March 2007. But he didn't stumble across a giant oil field, develop software, or inherit wealth. Rather, he built his fortune solely through astute investing. Aspiring investors, then, will certainly benefit by studying his methods. Fortunately, Buffett has been forthcoming in Berkshire's annual reports and shareholders meetings. (Click here to watch our Berkshire Hathaway Annual Meeting Preview video. And for on-the-spot coverage of this year's meeting, be sure to visit Morningstar.com on May 5 to read our analyst blog on the event.)

In Berkshire's 1977 annual report, Buffett described the central principles of his investment strategy:

"We select our marketable equity securities in much the way we would evaluate a business for acquisition in its entirety. We want the business to be one (a) that we can understand; (b) with favorable long-term prospects; (c) operated by honest and competent people; and (d) available at a very attractive price."

in Morningstar http://news.morningstar.com/article/article.asp?id=191671&pgid=wwhome1a

sábado, abril 28, 2007

Warren Buffet em Entrevista à CNBC - 1ª Parte

Primeira parte de uma entrevista de Warren Buffet a Liz Claman da CNBC. Foi um programa de 45 minutos onde nos é dado a conhecer um pouco melhor o segundo homem mais rico do mundo (ou terceiro), a sua personalidade, o seu método de investimento, o seu estilo de vida...

quarta-feira, abril 25, 2007

A Maestro of Investments in the Style of Buffett

By GERALDINE FABRIKANT

Published: April 23, 2007

CHICAGO — Warren E. Buffett is hardly a man of mystery.

But when investors gather in Omaha in two weeks for the Berkshire Hathaway annual meeting, there will be a nagging question mark over the head of the 76-year-old chairman: who might someday replace him in each of the two roles he plays — chief executive of Berkshire Hathaway, and its chief investment officer?

A bit more is known about the choice of a future chief executive. Mr. Buffett has said there are three candidates from various Berkshire-owned companies. Buffett watchers speculate that the list includes David L. Sokol of MidAmerican Energy Holdings; Ajit Jain, head of the reinsurance division of Berkshire’s National Indemnity Company; Tony Nicely, chief executive of Geico; Joseph P. Brandon, chairman of General Re; and Richard T. Santulli, founder of NetJets.

The bigger mystery is who will become the chief investment officer. Mr. Buffett says he does not know himself. On this point of succession, “frankly, we are not as well prepared,” he wrote in his 2006 shareholder letter last month.

Here is a clue, though. He or she will probably be a lot like Louis Simpson.

... http://www.nytimes.com/2007/04/23/business/23simpson.html?_r=3&pagewanted=1&ref=business&oref=slogin

Published: April 23, 2007

CHICAGO — Warren E. Buffett is hardly a man of mystery.

But when investors gather in Omaha in two weeks for the Berkshire Hathaway annual meeting, there will be a nagging question mark over the head of the 76-year-old chairman: who might someday replace him in each of the two roles he plays — chief executive of Berkshire Hathaway, and its chief investment officer?

A bit more is known about the choice of a future chief executive. Mr. Buffett has said there are three candidates from various Berkshire-owned companies. Buffett watchers speculate that the list includes David L. Sokol of MidAmerican Energy Holdings; Ajit Jain, head of the reinsurance division of Berkshire’s National Indemnity Company; Tony Nicely, chief executive of Geico; Joseph P. Brandon, chairman of General Re; and Richard T. Santulli, founder of NetJets.

The bigger mystery is who will become the chief investment officer. Mr. Buffett says he does not know himself. On this point of succession, “frankly, we are not as well prepared,” he wrote in his 2006 shareholder letter last month.

Here is a clue, though. He or she will probably be a lot like Louis Simpson.

... http://www.nytimes.com/2007/04/23/business/23simpson.html?_r=3&pagewanted=1&ref=business&oref=slogin

Subscrever:

Comentários (Atom)